Free loan calculator to determine repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Calculate the loan payment for a 20000 car or truck.

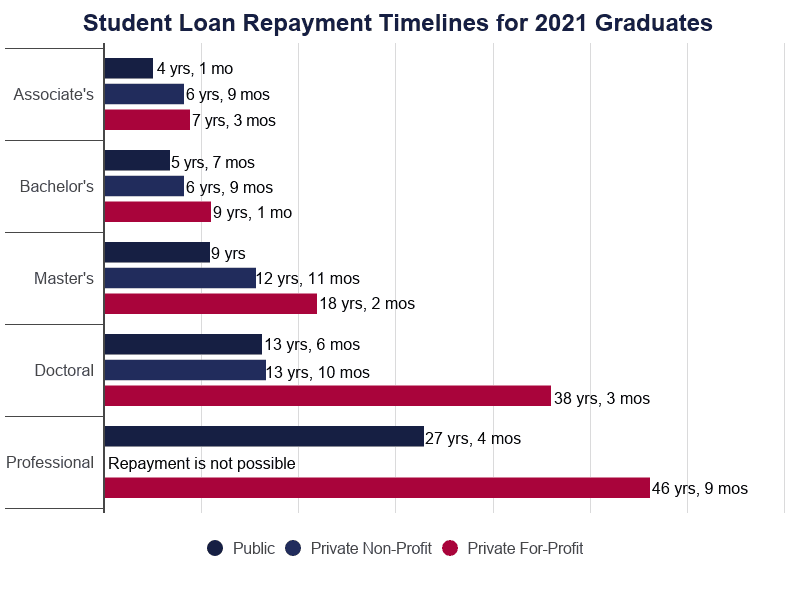

How To Pay Off 200 000 In Student Loans Credible

How To Pay Off 200 000 In Student Loans Credible

If you are purchasing raw land the preferred down payment can be as much as 30 to 50 of the total cost.

200 000 loan payment. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an. This calculator shows how long it will take to payoff 200000 in debt. Number of Monthly Payments 360.

Also learn more about different types of loans experiment with other loan calculators or explore other calculators addressing finance math fitness health and many more. How much will be paid in interest. 361 rows How much would the mortgage payment be on a 200K house.

Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000. Payment Number Beginning Balance Interest Payment Principal Payment Ending Balance Cumulative Interest Cumulative Payments. Use this business loan calculator with amortization to figure out your monthly payment.

Pay a higher downpayment or refinance to lower monthly payments. 58 rows This calculates the loan amortization payment table for a home loan car bus motorcycle. Shorter terms may pay off sooner but might have a higher monthly payment.

Add taxes insurance and maintenance costs to estimate overall home ownership costs. How much is a 20000 auto loan. 151 rows Can I afford a 200000 home.

This can add significant cost to the price of the mortgage. Common loan lengths are. Lenders also generally avoid issuing loans thatll run afoul of whats known as the 2836 rule which helps prevent borrowers from taking on too much debt.

What if I pay a bigger down payment. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 718 monthly payment. Payments are based on your interest rate loan amount and length of your loan term.

Just fill in the interest rate and the payment will be calculated automatically This calculates the monthly payment of a 200k mortgage based on the amount of the loan interest rate and the loan length. Pay a higher downpayment or refinance to lower monthly payments. But unless your down payment is at least 20 you will likely have to pay Private Mortgage Insurance PMI.

Subtract your down payment to find the loan amount. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Longer terms may have a lower monthly payment but you may pay more in interest over time.

Larger Down Payments Land loans typically require a larger down payment than traditional mortgages often as much as 20 to 30 of the asking price. It can be used for any loan credit card debt student debt personal business car house etc. You can often qualify for a mortgage with as little as 35 down.

This is called debt consolidation. Pay a higher downpayment or refinance to lower monthly payments. Can I afford a 200000 house.

Add taxes insurance and maintenance costs to estimate overall home ownership costs. Add taxes insurance and maintenance costs to estimate overall home ownership costs. To determine how much income you need for a 200000 mortgage keep in mind that the amount of the monthly payment on that mortgage will depend on your credit score and other factors.

Whats the monthly payment. Pay a higher downpayment or refinance to lower monthly payments. Shows the impact of extra payments and creates an amortization table.

Add taxes insurance and maintenance costs to estimate overall home ownership costs. Annual Interest Rate in percent Length of Loan in months Total Payments 36481342. Many times combining multiple high-interest loans into one low interest loan can be a good option.

Make sure to think. It assumes a fixed rate mortgage rather than variable balloon or ARM.

/payoff-b6a86aed50ab464fb416104c21a0c3d8.png)