The average for the month 300. Annonce Get the best reverse mortgage quote with our list of options.

30 Year Mortgage Rates Chart Historical And Current Rates

30 Year Mortgage Rates Chart Historical And Current Rates

The average for the month 283.

Mortgage refinance rates forecast. Use Our Free Reverse Mortgage Calculator. The average rate across all. But rates are currently hovering lower than this for well-qualified applicants.

Annonce Prime de 80 Versée Sur Votre Livret Taux Garanti à 330 pendant 12 mois. Mortgage rates are essentially unpredictable at the moment. Mortgage Refinance Interest Rates Forecast Mar 2021.

Weve been stuck with what one analyst called market indecision for the last couple of weeks. Annonce Prime de 80 Versée Sur Votre Livret Taux Garanti à 330 pendant 12 mois. May 1 2021 - 6 min read.

Todays mortgage refinance rates have risen compared to yesterday except for 30-year fixed which have not budged from 3 in five days. But in the second half theyve barely moved. That gaps likely to remain fairly.

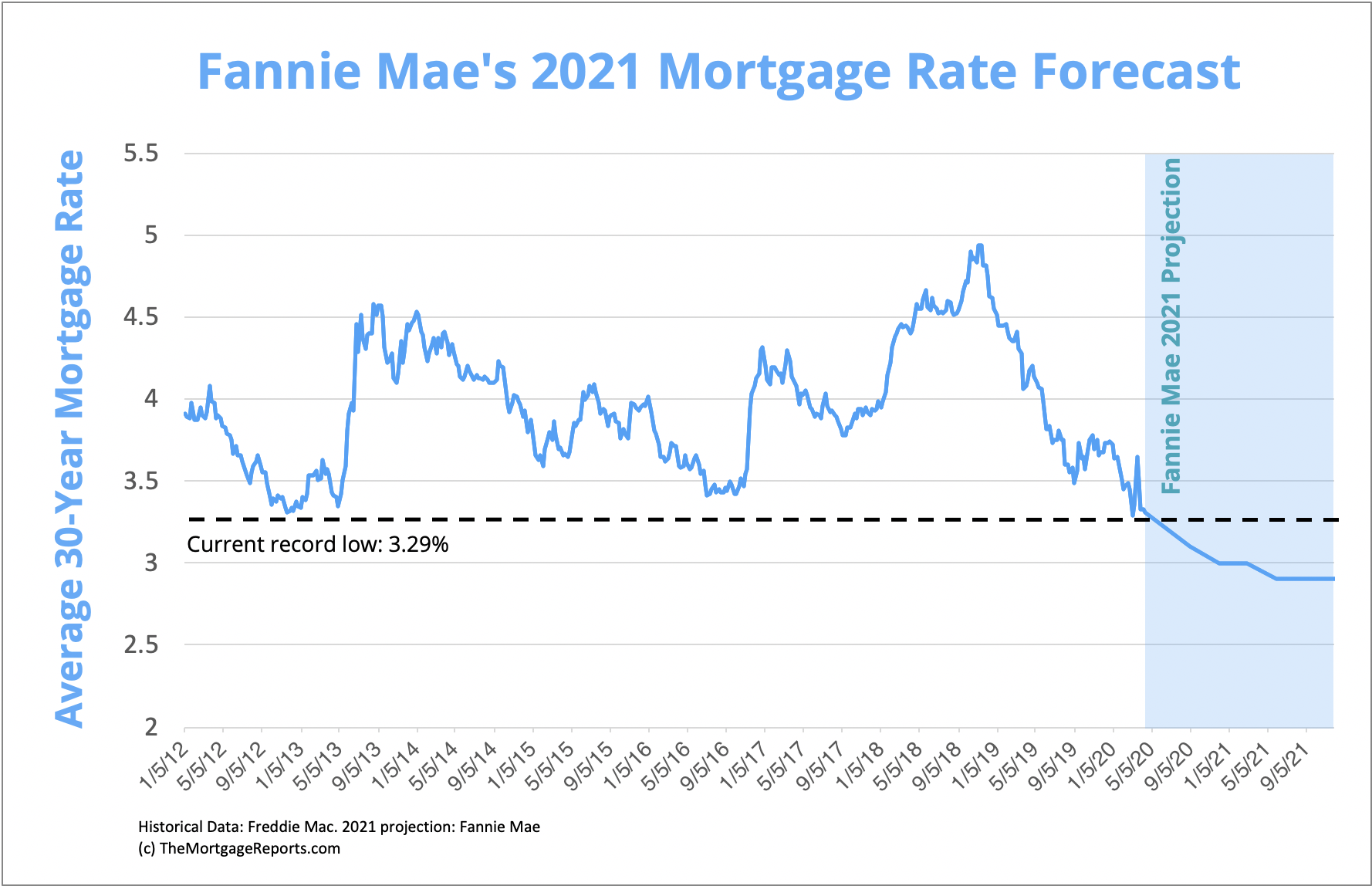

But when they turn up is anyones guess. Fannie Mae predicts mortgage rates in the record-low territory for the rest of 2020 and 2021. The 30 Year Mortgage Rate forecast at the end of the month 289.

Todays mortgage and refinance rates. But rates are still low overall so it could be a good day to lock in a mortgage rate. And while mortgage rates dropping below 3 percent is welcome news for many buyers I dont think this means well see record-low rates in the long run Fairweather says.

Peter Warden The Mortgage Reports editor. Mortgage and refinance rates have gone up since last Thursday. But note that refinance rates are currently a little higher than those for purchase mortgages.

30 Year Mortgage Rate forecast for August 2021. Mortgage interest rates forecast for next week. Mortgage and refinance rates today May 1 and rate forecast for next week.

Jusquà 100 000 Sans Frais Optimiser votre épargne. Mortgage and refinance rates usually move in tandem. Jusquà 100 000 Sans Frais Optimiser votre épargne.

This agency predicts 29 mortgage rates by 2021. No Sign Up Required. In the first half of April rates fell appreciably.

The Mortgage Bankers Association for instance expects rates to reach 36 percent by the end of 2021. What that would mean for home buyers and. Yes Im still expecting more rises sometime soon.

Todays mortgage and refinance rates Average mortgage rates edged lower yesterday. Todays mortgage and refinance rates Average mortgage rates inched higher yesterday. The 30 Year Mortgage Rate forecast at the end of the month.

And its that lack of a decisive direction thats forcing me to repeat my recent mantra. Annonce Get the best reverse mortgage quote with our list of options. The average rate since 1971 is more than 8 for a 30-year fixed mortgage.

Its forecast three months ago called for rates to hit 35 percent in late 2021. Maximum interest rate 315 minimum 289. Refinancing became a bit more expensive today as 30-year fixed and 15-year fixed refinance mortgages saw their average rates climb.

But also the third over the last seven working days. To see if 35 is a good rate right now. In the first half of April rates fell appreciably.

It was only the third rise in April. No Sign Up Required. Current Mortgage Refinance Rates.

But in the second But in the second Mortgage and refinance rates today May 1 and rate forecast for next week. Use Our Free Reverse Mortgage Calculator.