Ascena Retail Group is reportedly exploring a bankruptcy filing in an effort to manage its debt load and rework its finances. Including Barnes Noble AMC Regal Theaters Francescas LA Fitness Bed Bath Beyond Party City.

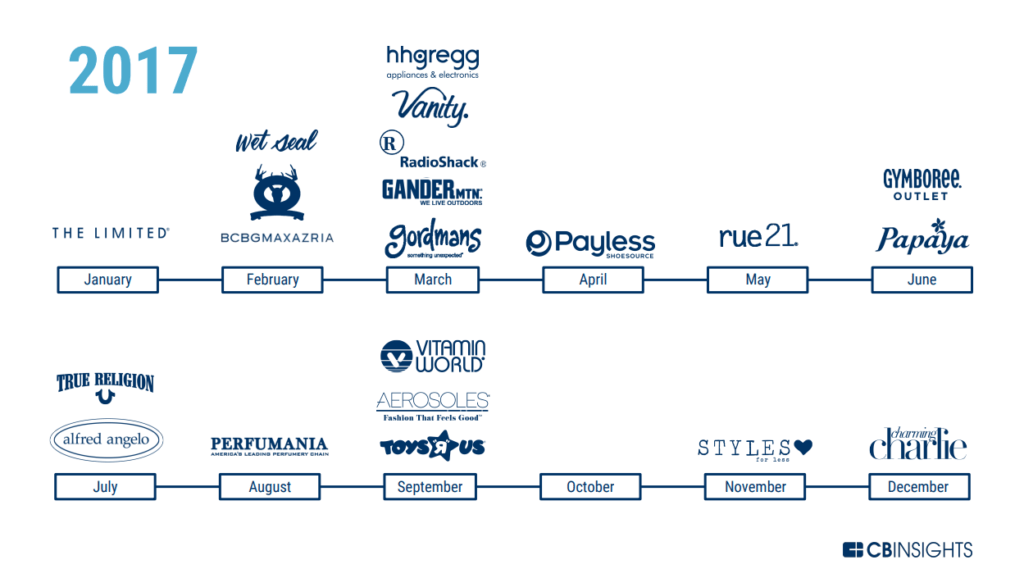

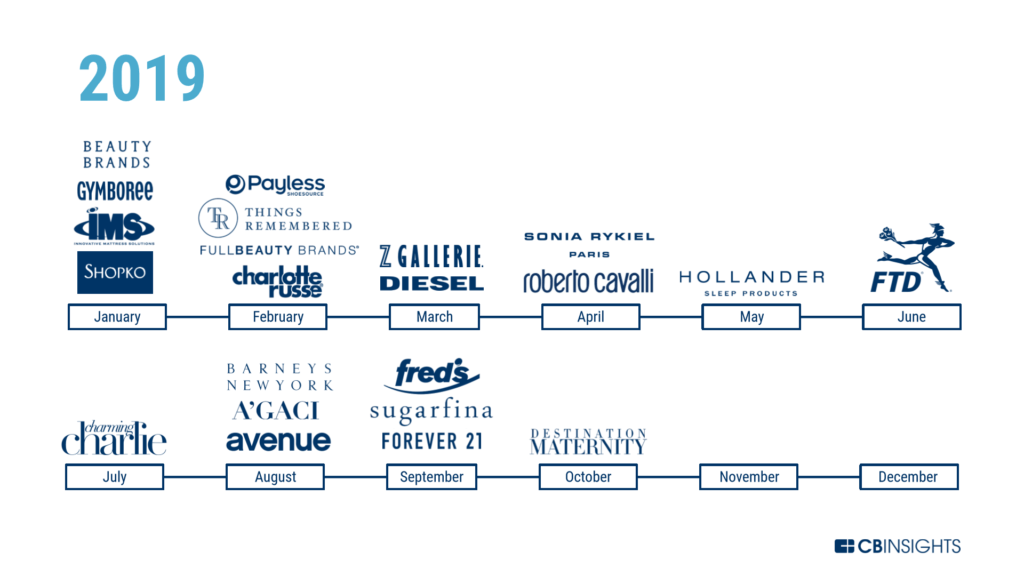

List Of Retail Company Bankruptcies Closing Stores Cb Insights Research

List Of Retail Company Bankruptcies Closing Stores Cb Insights Research

New York CNN Business The breakneck pace of retail bankruptcies slowed in August with at least three well-known companies filing for Chapter 11.

Retail stores filing bankruptcy. Retail Bankruptcies and Store Closures in the first half of 2020. The parent company of Ann Taylor and Loft Ascena Retail Group filed for Chapter 11 bankruptcy protection earlier this week on Thursday listing more. Loves was created through the liquidation of furniture retailer Art Van which filed for bankruptcy in 2020.

Last year sent 17 major retailers into bankruptcy. Advertentie Helping Businesses Families In Houston With Bankruptcy Since 1986. Please consider An Overview of US.

In the first six months of 2020 18 retailers filed for Chapter 11 bankruptcy with an additional 11 filing in July through mid-August. About 60 of the retailers that filed for bankruptcy in 2020 through August listed more than 100 million in assets compared with 50 of filings during the same period in 2019 and 36 in 2018 a. Penney Lord Taylor and Brooks Brothers.

Music instrument retailer Guitar Center was one of the most recent retailers to succumb to bankruptcy filing for Chapter 11 in November. The company founded in 1993 has been acquired by SPARC Group which owns retailers such as Aeropostale and. As of May 1 11 retail companies had a FRISK score of 1 indicating the highest risk with an estimated 10 to 50 chance of filing for bankruptcy.

BDOs mid-year Retail in. New York City-based department store chain Century 21 filed for bankruptcy in September and said that it will shut 13 locations that for years served up deep discounts on designer wares. Advertentie Helping Businesses Families In Houston With Bankruptcy Since 1986.

The following post will continue to be updated to reflect the current major retailers that have filed for bankruptcy protection in 2020. Retail Bankruptcies and Store Closures in 2020. Denim and apparel retailer Lucky Brand filed for Chapter 11 bankruptcy on July 3.

Following is our top retailers to watch for possible Chapter 11 filings in the year ahead. Destination Maternity filed for Chapter 11 bankruptcy protection on Monday coming on the heels of several other retailers that already filed earlier this year including Gymboree and Diesel. The retailer parent.

So far this year the retailers that have fallen include some big legacy brands like Neiman Marcus JC.