Most incarcerated people have in-prison jobs that pay a very small amount of and sometimes no money. The inmates income earned while incarcerated does not qualify as earned income for the Child Tax Credit CTC or the Earned Income Tax Credit EITC.

Preparing Tax Returns For Inmates The Cpa Journal

Preparing Tax Returns For Inmates The Cpa Journal

Income Earned While in Prison.

Filing taxes after incarceration. If you are married and want to file Married Filing Jointly MFJ you can. Thus treat the time that your spouse was incarcerated as if heshe was living at home. After youre released you must either have health coverage pay the fee or get an exemption for 2018 plans and earlier.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Married Filing Jointly and Proof of Marriage. Filing Although prisoners have no right to be paid for their work when inmates earn money they are required to file a tax return and pay any taxes owed by April 15th.

Once they are incarcerated many prisoners do not earn enough in wages to meet the minimum income requirements for filing federal income tax returns. Therefore the law does indeed allow for the filing of tax returns for incarcerated persons absolutely. The main thing that would affect your filing status is your marital status.

Income Earned While in Prison. For one you may be receiving other forms of income from investments income earned before you were incarcerated filing a tax return with a spouse who is still earning income for the household you may qualify for the EITC due to your spouses income etc. Just because you are in prison on one offense does not mean you should risk further incarceration for the commitment of another crime.

File taxes halts the accumulation of federal tax debts and prohibits the receipt of tax credits and deductions upon release. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. So why would you need to file a tax return while in prison.

Inmates may earn income for work in prison such as kitchen and laundry duties although their earnings are a fraction of those of their unincarcerated counterparts. It might not cross ones mind that an incarcerated person has to file a tax return but many of these individuals do meet the requirements to file. Because of being incarcerated the prisoner may file an extension but federal law clearly indicates that when taxes are owed they must be paid by the April 15 deadline even if an individual receives an extension for filing the actual forms.

Filing while in prison is often handled by a prisoners loved ones from outside the correctional institution. These products can be ordered through the toll-free number 800-Tax-Form 800-829-3676 from IRS Forms and Publications online by sending an email to the SPEC Partner email address or by contacting your local SPEC relationship manager. If an incarcerated person needs to file a federal tax return then he or she could authorize another person to complete it by executing either a durable power of attorney or signing Form 2848 Power of Attorney and Declaration of Representative which will permit another person to deal with the Internal Revenue Service on your behalf.

Incarcerated people like anyone else have to file a tax return if they have enough income. If you did not file taxes in previous years due to incarceration you have three years from the due date of your last tax return to claim any credits or refunds for which you may have been eligible. Do incarcerated people have to file tax returns.

If youre married and your spouse is incarcerated when it comes time to file your federal tax return you may be able to file as Married filing. How do you go about filing taxes when incarcerated. See IRSgov for details.

For one you may be receiving other forms of income from investments income earned before you were incarcerated filing a tax return with a spouse who is still earning income for the household you may qualify for the EITC due to your spouses income etc. Incarceration is considered being temporarily away from home and doesnt affect your filing status. If you have an income and do not file taxes you will be subject to prosecution for tax evasion.

However many inmates do have a legitimate need to file income tax returns due to income earned before incarceration joint income tax returns with spouses or tax obligations associated with. Starting with the 2019 plan year for which youll file taxes in April 2020 the fee no longer applies. If you did not file taxes and owe money you may be subject to penalties and interest.

If youre incarcerated pending disposition of charges. If the inmate performs services for any payor even a private company while in jail the wages. Incarceration neither changes ones obligation to pay taxes and tax debts nor prohibits the receipt of tax credits and deductions upon.

The government and the legal system wouldnt impose such a burden on the individual either since it would really be unfair to deny an incarcerated person the right file an income tax return.

Who Goes To Prison For Tax Evasion H R Block

Who Goes To Prison For Tax Evasion H R Block

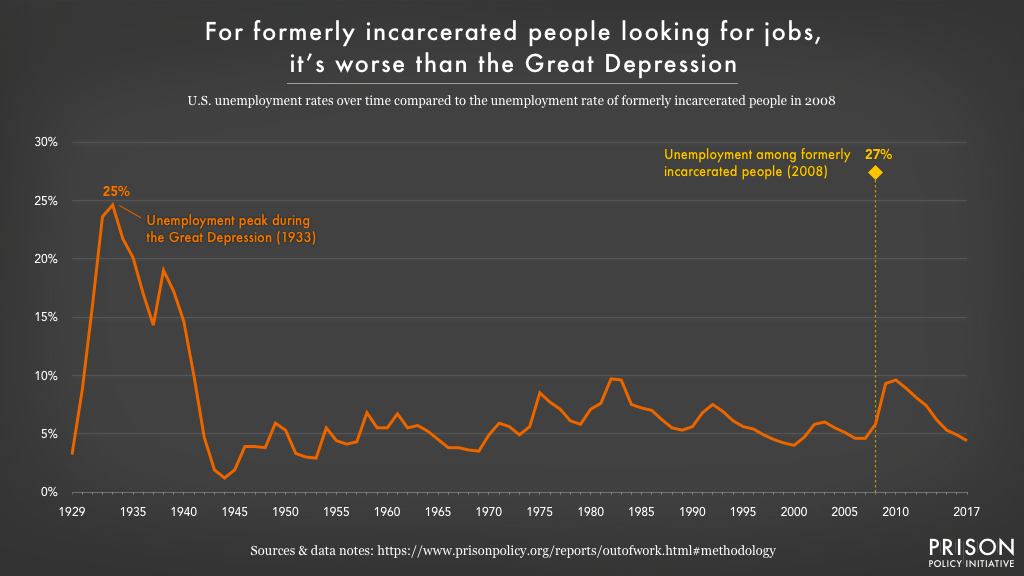

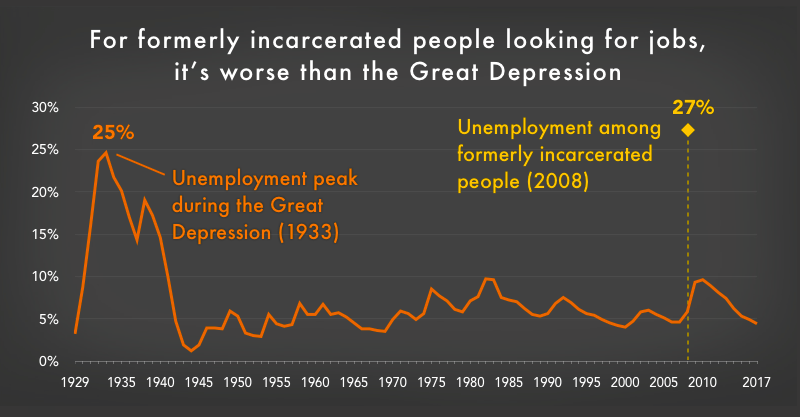

Out Of Prison Out Of Work Prison Policy Initiative

Out Of Prison Out Of Work Prison Policy Initiative

Https Www Brookings Edu Wp Content Uploads 2018 03 Es 20180314 Looneyincarceration Final Pdf

Filing Taxes If You Are Currently Incarcerated Or Re Entering Society Get It Back Tax Credits For People Who Work

Filing Taxes If You Are Currently Incarcerated Or Re Entering Society Get It Back Tax Credits For People Who Work

My Husband Is Incarcerated What Should My Tax Filing Status Be

My Husband Is Incarcerated What Should My Tax Filing Status Be

How Prisons Are Blocking Incarcerated People S Stimulus Checks

How Prisons Are Blocking Incarcerated People S Stimulus Checks

Do Inmates In Prison Pay Taxes On Any Earnings They Make While Incarcerated Quora

Do Inmates In Prison Pay Taxes On Any Earnings They Make While Incarcerated Quora

Nc Commerce Out Of Prison Out Of Work A New Normal For Ex Offenders In North Carolina

Nc Commerce Out Of Prison Out Of Work A New Normal For Ex Offenders In North Carolina

Can You Claim Someone In Prison On Your Taxes Prison Insight

Can You Claim Someone In Prison On Your Taxes Prison Insight

Preparing Tax Returns For Inmates The Cpa Journal

Preparing Tax Returns For Inmates The Cpa Journal

Prison Industrial Complex Wikipedia

Prison Industrial Complex Wikipedia

Https Www Irs Gov Pub Irs Utl Reentry Council Mythbuster Federal Taxes Pdf

Can I File My Boyfriend S Taxes If He Is In Jail

Can I File My Boyfriend S Taxes If He Is In Jail

Out Of Prison Out Of Work Prison Policy Initiative

Out Of Prison Out Of Work Prison Policy Initiative

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.