The executive order is. Government has suspended all federal student loan payments and halted all interest charges through the end of September 2021.

Here S Exactly How Student Loan Interest Works Student Loan Hero

Here S Exactly How Student Loan Interest Works Student Loan Hero

You do not need to take any action to put your loans into forbearance or stop making payments.

When are student loan payments due. And during that break interest accrual is. President Joe Biden on Wednesday extended the payment pause on federal student loans through at least September 2021. The CARES Act put federal student loans in forbearance a year ago at the start of the coronavirus pandemic but payments resume on September 30 2021.

Thats because the government suspended student loan payments and interest at the end of March 2020 due to the financial fallout from COVID-19. The freeze on those payments and interest now extends until October as part of the federal governments COVID-19 response but only applies to federal. The payment will be released in three chunks at the start of each term.

Borrowers will not have to make payments until October 1 at the earliest extending the already unprecedented pause on payments by eight months. Since March 27 2020 federal student loan interest rates have been set to 0 and payments have been paused. Millions of student loan borrowers received a welcome reprieve last month when President Joe Biden extended the suspension of payments and interest on federal student loans.

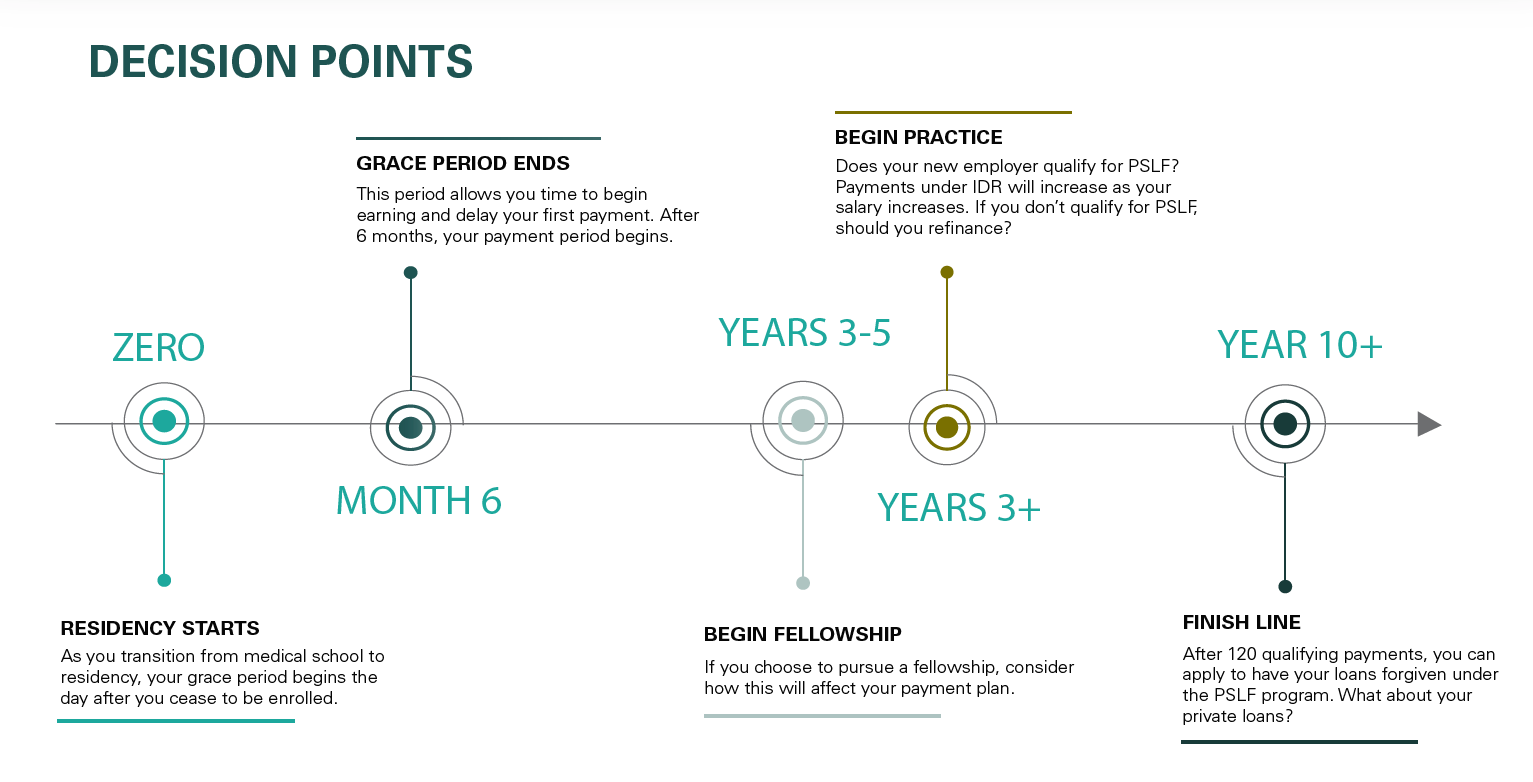

Financial attorney Leslie Tayne founder and managing director of Tayne Law Group PC shares helpful insight. Federal loans typically have a grace period of six months after you leave school. Generally speaking you have to make your first payment on federal student loans six months after you leave school.

That suspension has been extended several times including most recently through Sept. No interest will accrue on federal student loans through that date. However this student loan payment pause will not last forever.

If you have student loans and last attended school in the spring your. This applies to the person who graduates somebody who drops out of school or even those who simply fall below a halftime enrollment status. When you apply for a student loan you wont get the money straight away.

Some people though are still making their student loan payments. Getting borrowers to start paying again will be harder than it sounds. Most federal student loans come with a six-month grace period before new graduates have to start making payments on their college debt.

Thats partly because the loans arent accruing new interest so all payments are going. Borrowers will not have to make payments until October 1 at the earliest extending the already unprecedented pause on payments by eight months. Absent any extension your federal student loan payments will be due starting October 1 2021.

Normally you get the money on your first official. Student loan payments have been suspended since March 2020. Department of Education has said federal student loan borrowers dont need to pay their monthly bills for another eight to nine months.

Payments on federal student loans owned by the Department of Education DOE are suspended through Sept. At the same time all collections and garnishments on federal student loans in default have stopped as well. For millions of student loan borrowers payments are set to resume Jan.