Notice 2021-21 PDF provides details on the additional tax deadlines which have been postponed until May 17. Taxpayers and tax professionals should continue to use electronic options.

Was The Tax Year 2019 Tax Deadline Delayed What To Know About Coronavirus Covid 19 And Your Taxes The Turbotax Blog

Was The Tax Year 2019 Tax Deadline Delayed What To Know About Coronavirus Covid 19 And Your Taxes The Turbotax Blog

The dates are for Tax Year 2020 January 1 - December 31 2020 Income Tax Returns.

Date to file taxes 2020. This relief applies to all individual returns trusts and corporations. This extension however is only for. GSTHST credit including any related provincial credits.

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. The July 15 due date generally applies to all taxpayers who have an income tax filing or payment deadline falling on or after April 1 2020 and before July 15 2020. The tax-filing deadline for most Canadians for the 2020 tax year is on April 30 2021.

Although the 2020 tax filing season didnt open until February 12 2021 the IRS opened up Free File availability beginning January 15 for taxpayers who make 72000 or less. Will California also postpone the 2020 tax year due date for individual California taxpayers. Completed tax returns were held until they could be filed electronically after February 12.

Last year sweeping lockdowns to curb the spread of Covid-19 hit in the middle of the tax-filing season which led to the filing deadline being extended until July 15 2020. The IRS encourages taxpayers to file electronically. Sole proprietors file Schedule C with their personal tax returns to arrive at their net taxable business incomes.

Unless you choose to file for an extension see question below you must file and pay any remaining federal income taxes you owe for 2020 by May 17. Deadline to file your taxes if you or your spouse or common-law partner are self-employed. The year 2020 was a tumultuous year.

You have until Tuesday April 15 to file your 2020 returns. Deadline to file your taxes Jun 15 2021. File your tax return early or before the due date to avoid being charged interest and penalties and a disruption of your benefit and credit payments such as.

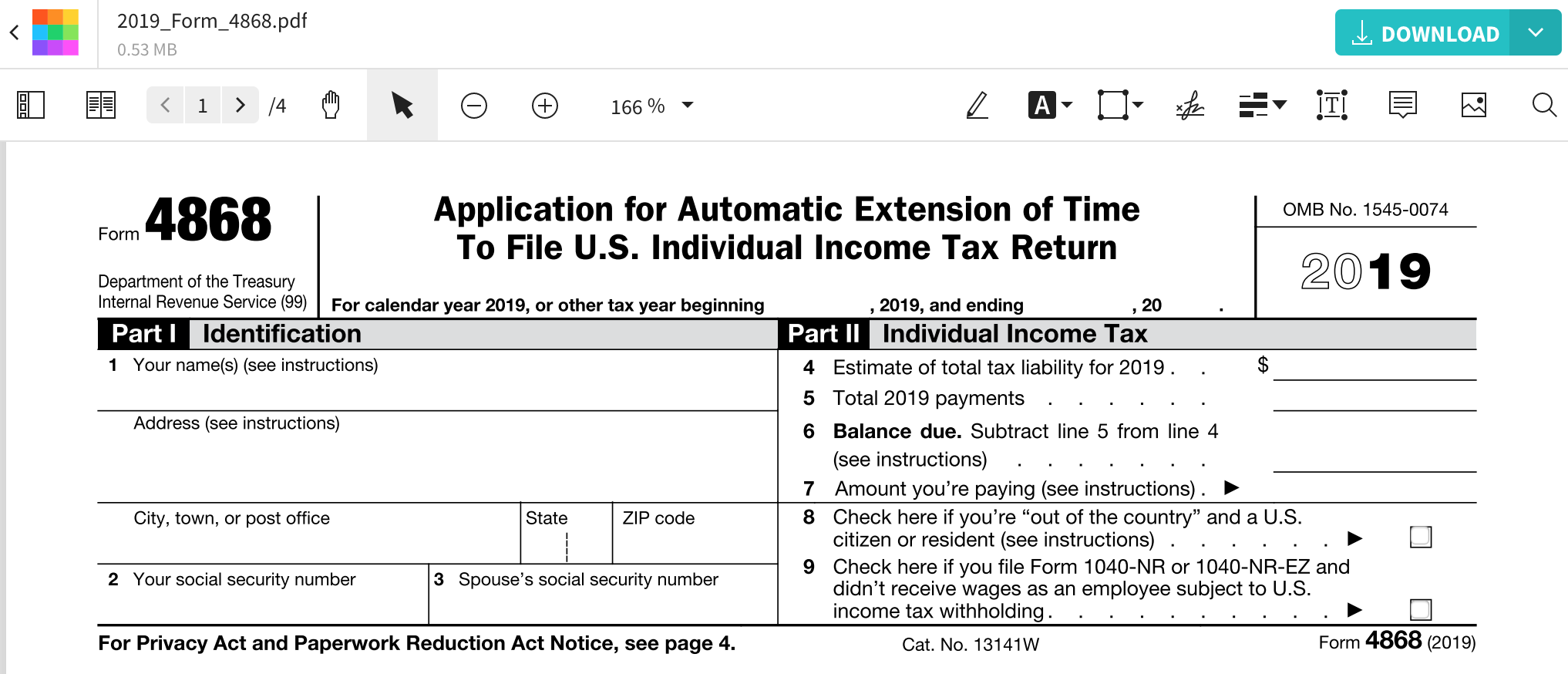

The deadline to submit this form is April 15. Find previous tax year forms deadlines and calculators and tax deadlines for back taxes. Taxpayers in that area who extended their 2019 tax returns to October 15 2020 now have until January 15 2021 to file those returns.

This follows a previous announcement from the IRS on March 17 that the federal income tax filing due date for individuals for the 2020 tax year was extended from April 15 2021 to May 17 2021. Filing dates for 2020 taxes Apr 30 2021. Dont be Penny Wise and Tax Foolish.

The IRS will be providing formal guidance in the coming days. 15 with Form 4868. The due date for the 2020 Schedule C is May 17 2021 because Schedule C is filed with the owners individual Form 1040.

If you have tax software or work with a tax professional it might be worth filing your returns now or at. So if you owe taxes for 2020 you have until May 17 2021 to pay them without interest or penalties. April 15th May 17 2021 for tax year 2020 tax returns.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15 2020 are automatically extended until July 15 2020. The IRS announced it is extending the 2020 tax year federal tax filing due date for individuals only from April 15 2021 to May 17 2021. For those who are self-employed or who have a spousepartner who is self-employed the deadline extends until June 15 2021.

What if I made a mistake and need to refile my taxes. For example the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires. If you need more time though you can file for an extension to Oct.

Filing due dates for the 2020 tax return Your return for 2020 has to be filed on or before April 30 2021. That way you will avoid being hit with any.