Form 4868 is available on IRSgovforms. If youve calculated that you probably owe tax write a check for that amount and mail the extension form with your check.

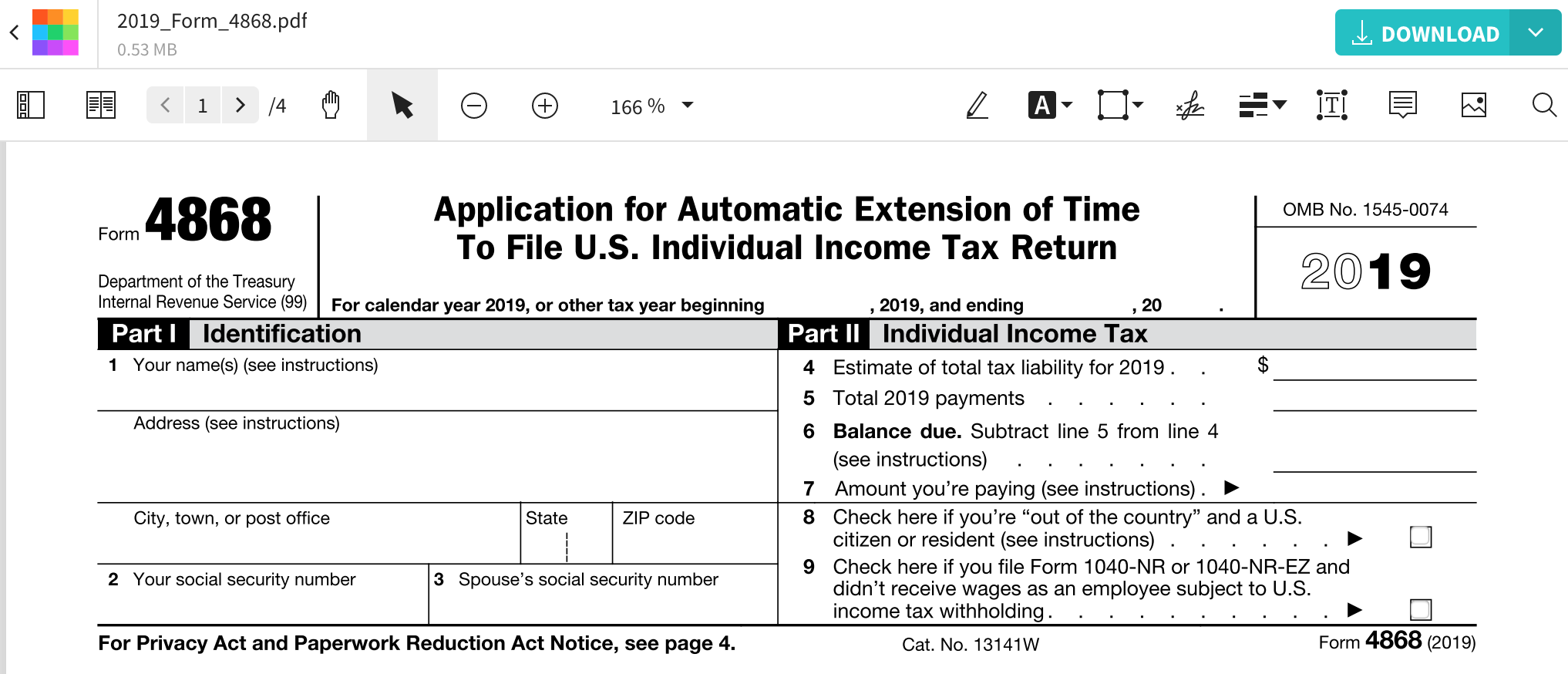

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Heres how to do it.

How to file a tax return extension. Individual taxpayers will be granted a 6-month extension of time to file by making an extension payment online using IRS Direct Pay. To get the extension you must estimate your tax liability on this form and should also pay any amount due. You cannot file your 2020 tax return by May 15 2021.

How to File for anExtension of State Taxes. If your paid preparer is required to e-file your tax return and is also preparing your extension request the preparer must e-file your extension request. Enter your Social Security number on line 2.

Taxpayers should pay their federal income tax. You can file a tax extension online using Form 4868 which lets you request an automatic extension of time to file your income tax return. Submit your tax extension electronically or by mail.

An extension to file your tax return is not an extension to pay. Use IRS Form 4868. While the IRS requires you to file Form 4868 for your federal extension each state has its own requirements for obtaining a similar state tax extension.

Taxpayers may file online through myVTax or submit Form IN-151 Application for Extension of Time to File Form IN-111 by the April due date. Individual Income Tax Return. Enter your name and address on line 1 of Form 4868.

Fiscal year filers should contact us to request an extension. If you are an individual tax filer and you need a tax extension you simply have to submit a single form to the IRS. In order for a taxpayer to be granted the extension the taxpayer must indicate the reason for payment is an extension.

Individual Income Tax Return from the IRS website. How to file a tax extension for your small business 1. E-file your federal tax extension in minutes with TurboTax Easy Extension.

Filing Form 4868 gives taxpayers until Oct. You owe tax for 2020. Easy options for filing an extension.

The online and e-file options provide you with a confirmation that we received your extension request. Make an estimated tax payment I cant stress this enough. Filing your federal tax extension online or through mail doesnt extend the time to pay a balance due.

How to file a tax extension. Fill out a request for an extension using Form 4868 Application for Automatic Extension of Time to File US. To pay electronically visit our payment options.

Make a payment of any tax due directly from your checking or savings account. Learn below if you should even eFile an extension or not. You can file for an extension with our online program.

How to File for the Extension Download Form 4868 the Application for Automatic Extension of Time to File US. 15 to file a return. Print a PDF copy of your e-filed extension.

Make a payment on the IRS website or the IRS2GO mobile app that covers all or part of your estimated tax bill it will automatically process an extension for your tax return. You can get an extension on filing your tax return but you. The deadline to e-File a 2020 Tax Extension will be April 15 2021 May 17 2021.

Pay the amount you owe by May 15 to avoid penalties and interest. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. 15 by filing Form 4868 through your tax professional tax software or using the Free File link on IRSgov.

Using TurboTax Easy Extension you can. More time to file is not more time to pay. Use Payment for Automatic Extension for Individuals FTB 3519 to make a payment by mail if both of the following apply.

E-file your federal extension. The extension allows additional time to file but it does not extend the time to pay any tax due. The deadline for mailing the form to the IRS is April 18.

Form 4868 Application for Automatic Extension of Time To File US. If you need even more time to complete your 2020 federal returns you can request an extension to Oct. E-file Your Extension Form for Free Filing this form gives you until Oct.

Regardless of which method you choose youll need to fill out Form 4868 and submit it by the IRSs extended deadline of May 17 2021. File Form 4868 for an automatic IRS personal tax return extension Pass-through businesses sole proprietorships.

Tax Extension Form Extend Tax Due Date If You Need

Tax Extension Form Extend Tax Due Date If You Need

File An Extension For Your Federal Tax Return Raleigh Cpa

File An Extension For Your Federal Tax Return Raleigh Cpa

/486990777-56a938bc3df78cf772a4e5f7.jpg) How To File A Tax Extension For A Federal Return

How To File A Tax Extension For A Federal Return

Tax Extension Form Extend Tax Due Date If You Need

Tax Extension Form Extend Tax Due Date If You Need

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

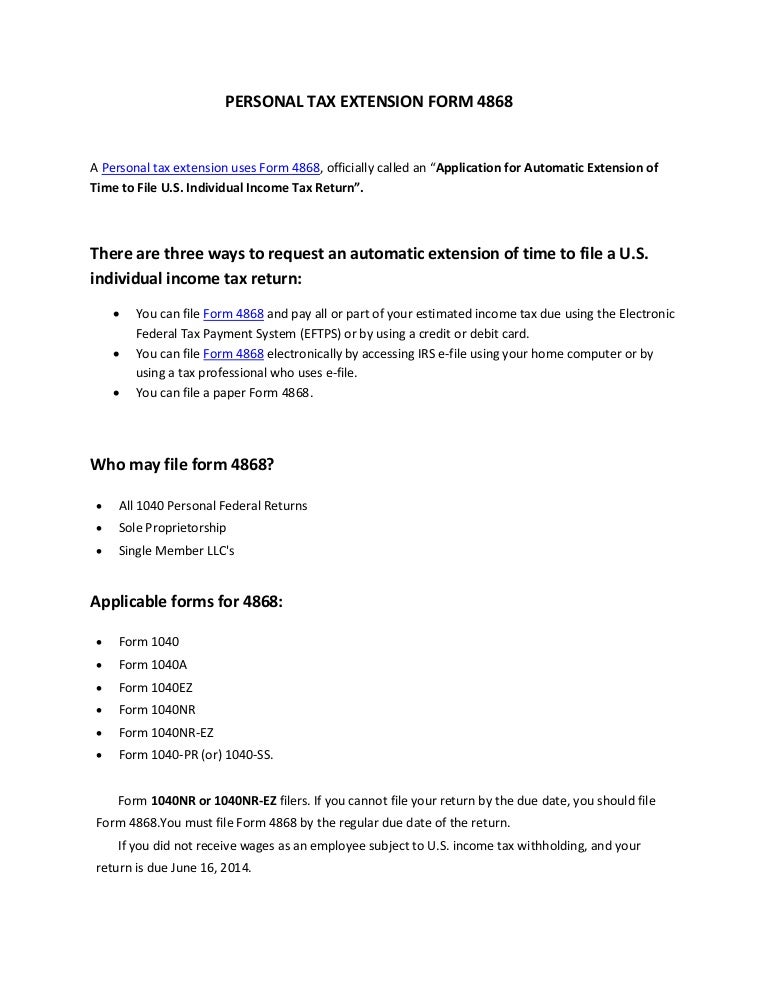

Personal Tax Extension Form 4868

Personal Tax Extension Form 4868

Here S How To File For A Tax Extension

Here S How To File For A Tax Extension

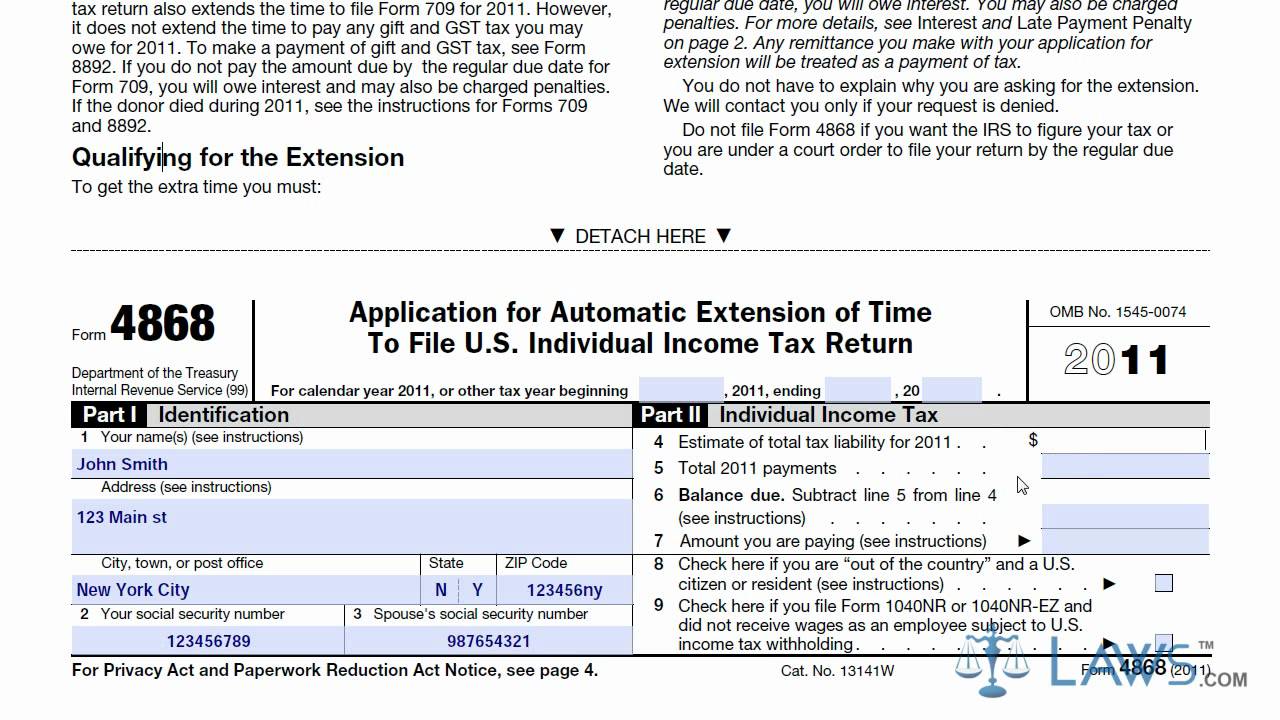

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Https Www Irs Gov Pub Irs Pdf F4868 Pdf

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Tax Extension Form 4868 E File By May 17 2021

Tax Extension Form 4868 E File By May 17 2021

:max_bytes(150000):strip_icc()/Screenshot64-177a60f2f4d6482eb80dfbc1be971169.png)

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.