Log into PAYE Services within myAccount and select Claim unemployment repayment. Use the online service fill in the form on-screen print it off and then.

Ppi Or Affordability Refund Get Back The Tax Deducted Debt Camel

Ppi Or Affordability Refund Get Back The Tax Deducted Debt Camel

How long will my tax refund take.

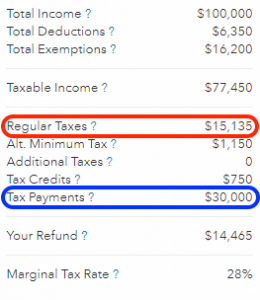

Get tax back. Income Tax is taken from the money you earn each year but everyone. Pay from your current or previous job. Your taxable income is any amount of income that you received that is in excess of your combined deductions and exemptions.

If you become a permanent resident during the tax year you may be able to get some of those higher taxes back. If you worked in Ireland for part of the year and you have now gone to live abroad you may be due a refund of tax. 2 weeks when you file online.

Unfortunately a 21-day delivery of your tax refund isnt guaranteed. To claim tax relief or any tax refund youre owed and to tell HMRC about any UK income you continue to get you can either. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

You may be able to get a tax refund rebate if youve paid too much tax. The IRS gets an avalanche of late-filed returns in the month before the deadline usually. If you are not e-enabled you will need to send the following to your Revenue office.

See if thats more or less than what youve had withheld look on your end-of-year W2 form. Get information about tax refunds and updates on the status of your e-file or paper tax return. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more.

Knowing what taxes you get back when you file your tax return helps you understand how much youre actually paying in taxes. Use this service to see how to claim if you paid too much on. A completed Form P50.

Whether you use a professional or file your own taxes the key to getting your refund fast is filing early. The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks. The Canada Revenue Agencys goal is to send your refund within.

Es gibt so viele Menschen die ihre Steuern zu hoch bezahlen ohne es zu wissen. Get Tax Back has been helping people claim back tax since 2008. The government typically doesnt automatically make these changes for you and reassess your tax.

These timelines are only valid for. Claim a tax refund. How to Get Tax Back.

Es gibt mehrere Gründe warum Sie Ihre Steuer zurückerstattet bekommen könnten. The earned income tax credit is worth up to. Find out if Your Tax Return Was Submitted You can file your tax return by mail through an e-filing website or software or by using the services of a tax preparer.

Our ethos is simple we through our expertise take the hassle out of claiming tax back. Jedes Jahr erbringen wir 322000 Steuerrückerstattungen. Using the IRS Wheres My Refund tool.

In addition you can get even more back than you paid in if you qualify for refundable tax credits. To claim a refund. Find your total income tax owed for the year I suggest using this tax calculator for a rough estimate.

You can receive a refund of federal and state income taxes withheld during the year if your actual tax liability is less than what was withheld. What is my personal allowance. 8 weeks when you file a paper return.

Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. A tax credit is a dollar-for-dollar reduction of the tax you owe and a refundable tax credit will allow you to have a credit beyond your tax liability. We offer an excellent and competitive service.

The best way to guarantee the quickest refund and stimulus payment is to file your tax return electronically and use direct deposit to your bank account. You must file an income tax return to get a refund of any taxes that have been withheld. However because it is relatively easy to claim tax back yourself you should only consider using one if you do not think you will claim on your own.

To get a rough estimate of how much youll get back then you need to. The exception to this is if you have very complex tax affairs in this case it is likely to be sensible to get advice from a qualified accountant. The only way to legally get back all of the federal income taxes you have paid into the IRS is to show that you have not received any taxable income during the tax year.