Critics of student loan debt forgiveness including conservatives and some liberals argue that it would unfairly benefit higher-income earners with. Also you could get.

The Case Against Student Loan Forgiveness

The Case Against Student Loan Forgiveness

Teacher Loan Forgiveness If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans.

What are the chances of student loan forgiveness. Heres where the situation stands now when it comes to student loan forgiveness. 1 Democrat supports student loan forgiveness but not a plan tied to an arbitrary amount 37 Congressional Democrats in both the House and. House Democrats passed legislation in May calling for 10000 in student loan.

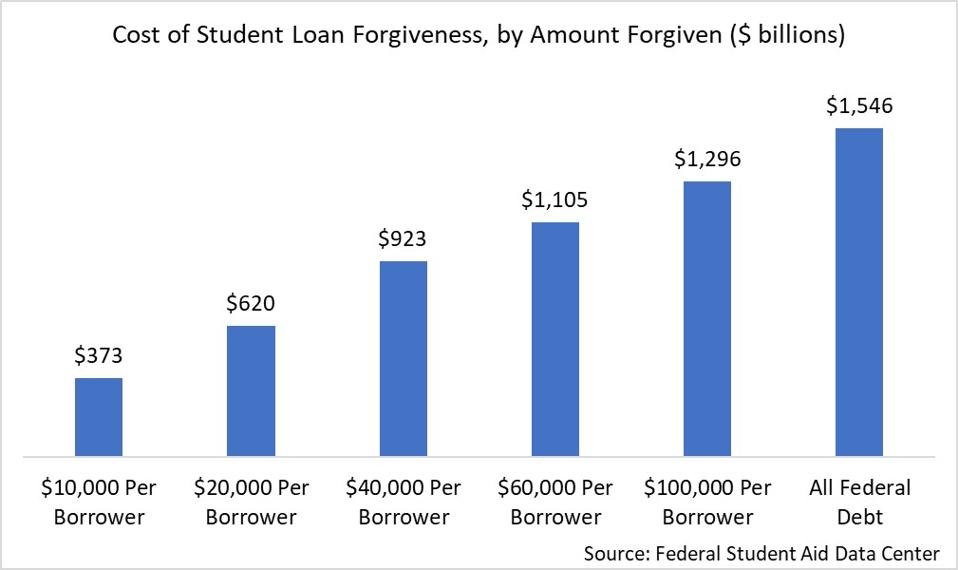

Kantrowitz estimates that offering 10000 in forgiveness per borrower for all federal student loan borrowers would cost about 377 billion whereas forgiving 50000 in debt for all borrowers will. With most forms of student loan forgiveness if the lender forgives 50000 the government will tax the borrower as though they made an extra 50000 in that particular year. Yes but theyre not so widely available -- or quick to receive.

Thus barring a seismic shift in policy positions the chances of student loan forgiveness legislation passing the Senate remain quite low. Elizabeth Warren D-MA has proposed forgiving student loan debt for millions of borrowers on a sliding scale based on income but the evidence about what the effects of this forgiveness. Proponents of 10000 in student loan cancellation argue that a smaller level of forgiveness would target the relief towards lower-income individuals.

Interest is temporarily at 0 on federal student loans to provide relief to student loan borrowers during COVID-19. If all federal student loan borrowers got 10000 of their debt. If student loan forgiveness is enacted there would almost certainty be caps on the amount that would be cancelled.

At the moment the main point of contention among student loan forgiveness proponents is over how much debt should be scrapped. The taxation of student loan forgiveness is often called the forgiveness tax bomb. Borrowers are also automatically in.

There is a strong likelihood of some form of student loan forgiveness in the near future but the amount will likely cover only a portion of your student loans. Yes but theyre not so widely available -- or quick to receive. The IRS treats forgiven debt as income.

Well continue to update this story as it develops. The risk is that student loan debt is not only crippling Americans financially. At the moment the main point of contention among student loan forgiveness proponents is over how much debt should be scrapped.

This will undoubtedly increase pressure on President. Since 10000 in student loan forgiveness is the proposal most likely to turn into reality Mayotte said she sees nothing wrong with people who owe under that amount redirecting their usual. While many in Congress are on board with such proposals in general others support it mainly as a means of stimulating the economy.

Economically distressed for example refers to a student loan borrower who would otherwise pay 0 monthly through an income-driven repayment plan was in. Public Service Loan Forgiveness is a government program intended to forgive federal direct student loans if the borrower has a job. Forgiving or cancelling 10000 in student.

Public Service Loan Forgiveness is a government program intended to forgive federal direct student loans if the borrower has a job. Though student loan forgiveness could give a boost to the economy its not necessarily the most effective form of stimulus compared to other options.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/EMPZ5XPC6NCTBCGSOSBRHUMUHI.jpg)