Getting a loan from Chase Bank is a straightforward process. Since in running any business time is crucially important such.

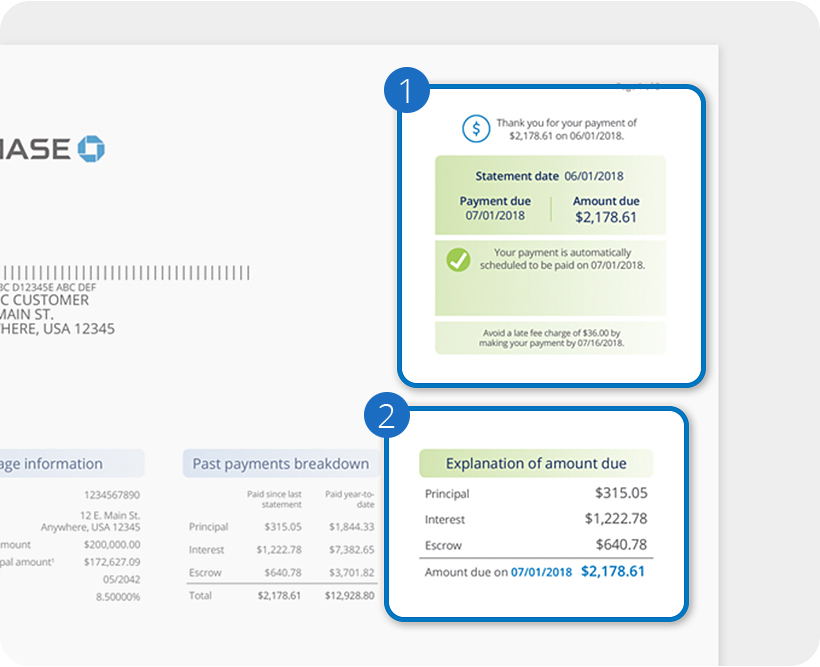

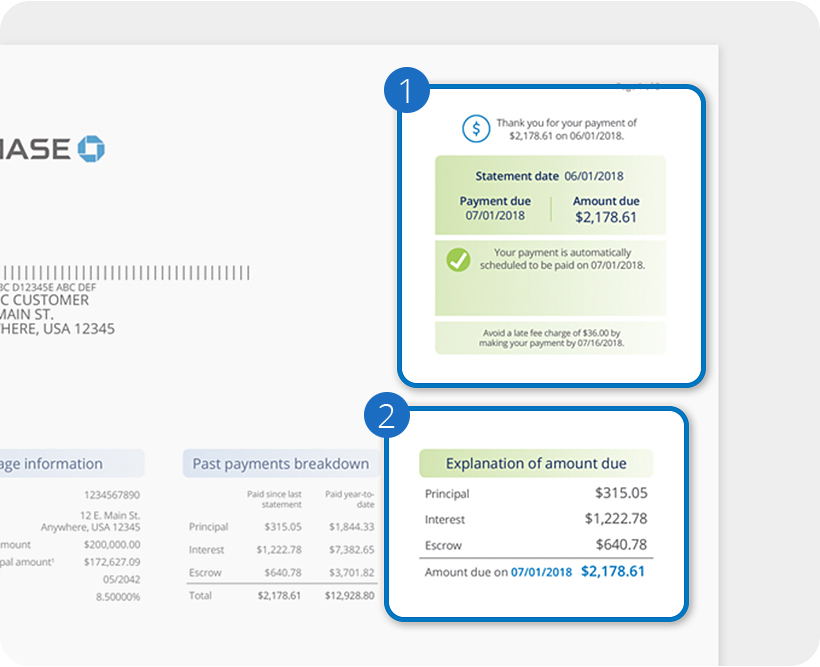

New Statements Home Lending Chase Com

New Statements Home Lending Chase Com

When applying for a bank loan you might be asked to submit your business plan.

How to get a business loan from chase bank. 2 Business Days - Your title or lien release is sent in approximately 2 business. If approved your small business is able to borrow up to a certain amount of money from the bank. One of the best benefits cited by consumers regarding Chases small business loan is how fast the money is received.

Youll need an active business checking account to apply with us. If you wonder how to get a personal loan from Chase Bank there are certain instructions given by the representatives of this financial institution. Use a Business Loan or Line of Credit to pay off large expenses or meet unexpected needs.

Apply for small business financing with Chase and expand your business. Applying for a personal loan up to 5000 is very easy if you deal with Chase. A lenderbe it a bank finance company or any other expects a prospective borrower to have convincing answers to three main aspects of a business loan.

Apply for a business loan Update March 29 2021. If the bank isnt confident that you can submit your monthly payment on-time and in-full you probably wont get approved. You can only apply for a Chase business loan in person.

Ultimately bankers will be more likely to approve your application if they think youll remain successful after receiving your loan. Generally you need to follow these steps. As long as you stay.

Get these ready ahead of time to expedite the process. You need to use specific numbers that detail your big-picture strategy including how youll earn money how much money youll earn and how youll spend that cash. Your business banker can be a valuable resource as you prepare to apply for financing.

Your business plan is essential to get approved for a loan. Small-business owners now have until May 31 2021 to apply for a first- or second-draw loan through the Paycheck Protection. To allow the company can research your credit history youll need to provide some.

Have a proper business plan In order to secure a loan many banks need you to have a strong financial plan which brings out what your business entails. Although it may seem tedious your business plan can help the bank determine the right loan. Explore our Small Business Resources and learn how to get started manage and grow your existing business.

Find your local branch by visiting the Chase website clicking ATM Branch in the top menu and entering your ZIP code. It may take up to 10 days upon account opening before you are able to apply for a PPP loan. In some cases funds are deposited into a borrowers account in as little as a couple days after approval.

This cant be emphasized enough. Here are seven steps to take when applying for a business loan from the bank. Requirements will vary but banks and the Small Business Administration typically request business and personal tax returns a current profit and loss statement and business licenses and registration.

Your titlelien release will be sent to the address that appears on your auto account statements generally in 2-10 business days from payment posting based on your payoff method or the state you live in. Save for Your Future. First and foremost Chase Bank is known as the quickest small business loan provider.

Customers also like the quick application process which is secure and streamlined. You can work with a Chase banker or begin the application online. For most of Chases consumer loan products youll need to take the following steps.

Learn more about SBA Loans and how to qualify. Open a Chase business checking account here or at your local branch if you dont have one. If you dont have one yet its time to create one.

What Ranks Chase Bank that High. Funds approved can be credited to you within as short as a couple of days. The specific need for which the loan.

Apply online on the official website of the bank to contact one of the Credit Managers. You can apply on the 11 th business day. Most banks wont even look at your application if your personal credit score does not exceed 700 even if you have a thriving business.

To apply for a personal loan you should visit the website of the company youll be getting the loan from. A foreign business loan is defined as a viable funding option for a business from a foreign bank or financial lending house especially if they have overseas connections or if they are expected to execute a project in the countries where the foreign banks. As you accrue debt you only pay interest on the amount youve used so far.

To clear the air lets go over the general requirements for a business loan from a bank.

Online Learning King Jones Bbq And Foot Massage Is Jones Bbq Foot Massage Real Jones Bbq And Foot Massage Location Online Learning King

Online Learning King Jones Bbq And Foot Massage Is Jones Bbq Foot Massage Real Jones Bbq And Foot Massage Location Online Learning King

/cdn.vox-cdn.com/uploads/chorus_image/image/66315800/confsunpm.cit_0663.0.jpg)