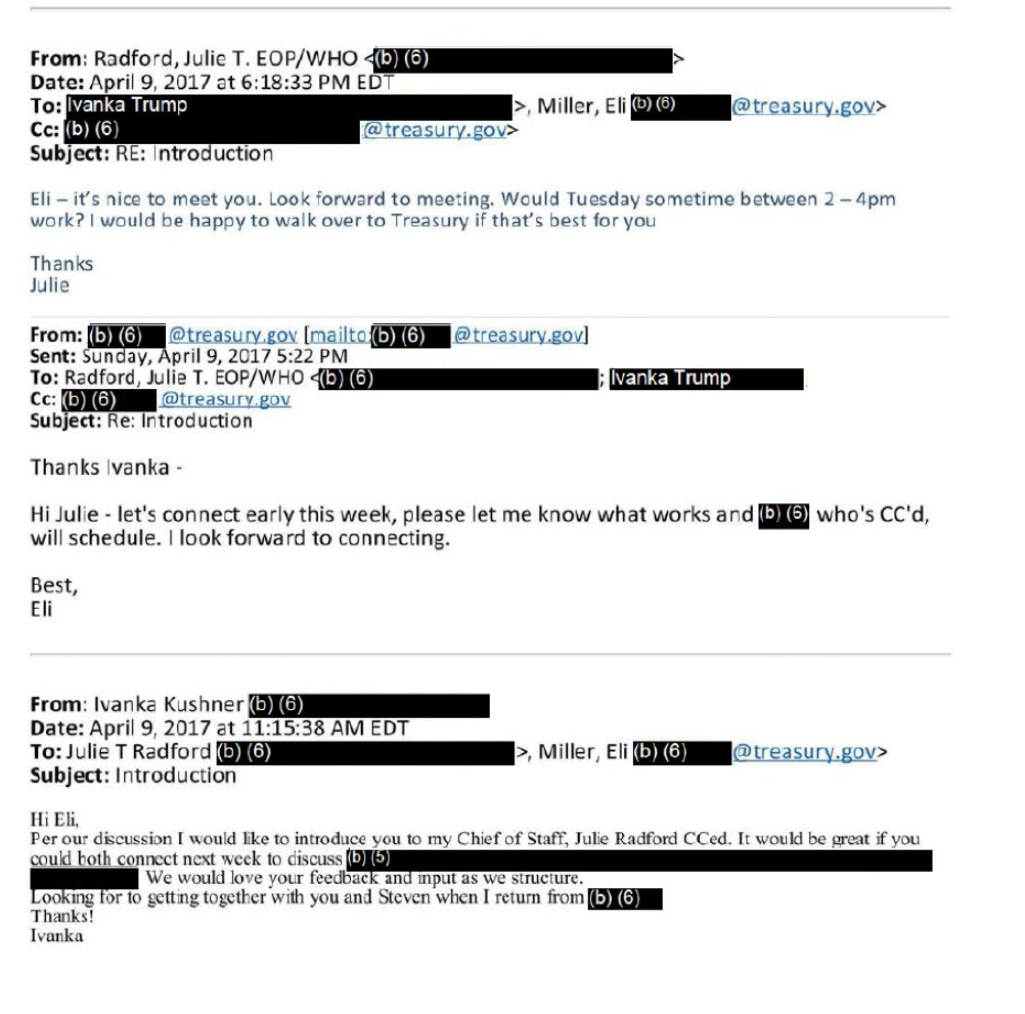

If that incarcerated person inmate knows somebody that they highly trust then that person can has the ability to personally file their zero income tax if they had no income in 2019 with a good address e-mail address bank account info then there shouldnt be an issue with them receiving the stimulus credit money if you do all of the above without including the bank account info then the check will. Prisoners without access to the internet can have someone file a claim for them or they can complete a paper application.

Missing Stimulus Payment But Aren T Required To File Taxes Irs Says You Ll Have To File This Year To Get That Money Abc7 Chicago

Missing Stimulus Payment But Aren T Required To File Taxes Irs Says You Ll Have To File This Year To Get That Money Abc7 Chicago

The IRS has issued all first stimulus checks.

How do inmates file for stimulus check. If that incarcerated person inmate knows somebody that they highly trust then that person can has the ability to personally file their zero income tax if they had no income in 2019 with a good address e-mail address bank account info then there shouldnt be an issue with them receiving the stimulus credit money if you do all of the above without including the bank account info then the check will. Inmates in the Racine County Jail for example who will be mailed a stimulus check will have their money submitted by the jail into the individuals trust account. How do you file for stimulus check for inmates.

I n September when a federal judge ordered that people who are incarcerated could receive pandemic stimulus checks activist groups rushed to inform the nations prisoners. Since prison and jail inmates dont have access to the internet and because many prison officials didnt give their inmates the chance to file the physical paperwork many prison inmates missed out on these payments. There is nothing in the CARES Act that gives the IRS authority to decide that incarcerated persons are not eligible for stimulus checks said Senator Sherrod Brown D-Ohio Inmates who are disproportionately people of color and from low-income communities already suffer from a lack of resources and increased exposure to Covid-19 due to the prison systems failed response to the virus.

1 and the payment status is not available then you need to contact the IRS. You can check the status of your payment by visiting the IRSs portal. You need minimal information to file a claim i e your name prison mailing address dob ssn.

You should have received your first stimulus check by November 13 2020. Chief Judge of the Northern District of California Phyllis J. After months of legal limbo incarcerated persons in the United States may finally be able to claim their coronavirus stimulus checks.

The deadline to file the physical paperwork for a stimulus check claim was November 4 2020. In fact if a person in jail or prison gets a payment theyre supposed to return it to the IRS immediately. Citizen permanent resident or qualifying resident alien.

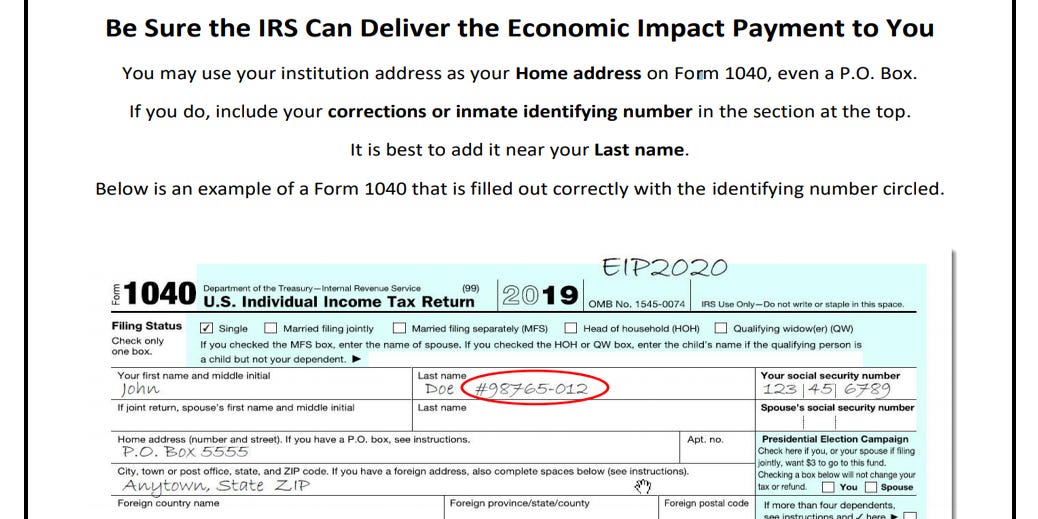

How Inmates Should File For Stimulus Checks. Use line 30 on the tax return 13News is also getting many questions about whether inmates SHOULD get stimulus checks. Volunteers from Prison Abolition and Prison Support PAPS dashed off 3000 letters containing informational packets and copies of IRS Form 1040 which many incarcerated people would need to fill out to receive their CARES check.

In case your stimulus check didnt arrive by Nov. 1 Use the IRS Free File Program delivered by TurboTax. The deadline to file an online claim was November 21 2020.

You can do this in several ways. Now as per the courts order the IRS needs to automatically re-process such claims by Oct. We can verify that depends on your perspective.

Misael617 An inmate must file a 2020 tax return to claim a Recovery Rebate Credit even if otherwise not required to file a tax return. However if they did not file a 2018 or 2019 tax return and their income was below 12200 or 24400 if filing jointly in 2019 then a claim must be filed through the IRSs website. Send a copy of the POA you have along with a Form 8453 Transmittal Form to the IRS.

When the checks show up. Non filers will need to provide the. This comes after a federal judge reversed an initial attempt by the Internal Revenue Service to disqualify inmates from receiving stimulus payments.

Inmates and their loved ones should move quickly given the impending deadlines to submit a claim and receive a stimulus check in 2020. For eligible inmates who did not get one or both of the stimulus payments in 2020 the IRS advises filing a tax return to claim a Recovery Rebate Credit. You can prepare the return on his behalf print it out and he can.

4 deadline to file physical paperwork now passed inmates. Here is a list of addresses. With zero income she will probably need to put a 1 interest income to allow the filing.

According to the IRS an incarcerated person does not qualify for a stimulus check. The entire payment should be returned unless it was made payable to joint filers and only one spouse is incarcerated. Complete the return and e-file as usual.

If you requested your first stimulus check by using the IRS Non-Filer Form or filing a simplified tax return you should have received your payment from the IRS. To receive the stimulus money the inmates have to fill out a 1040 tax return for 2020 requesting a recovery rebate However by filing the tax return prisoners are. Hamilton ruled earlier this month that the federal government could not bar individuals from claiming their stimulus check administered under the CARES Act based solely on their incarceration status.