Unemployment benefits are generally treated as income for tax purposes. Some extra money might be headed your way if you received unemployment benefits -- and paid taxes on those benefits -- in 2020.

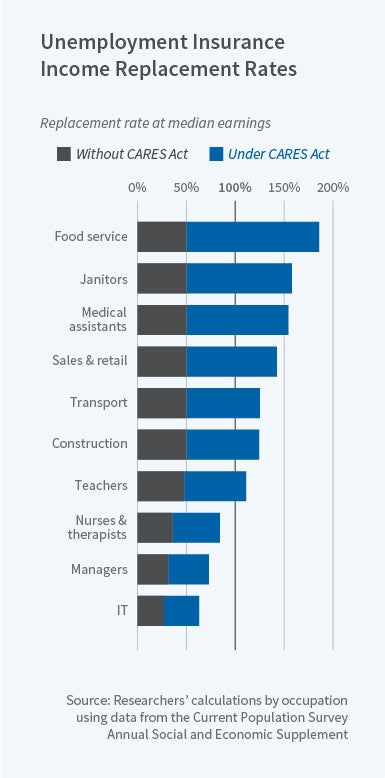

Unemployment Benefit Replacement Rates During The Pandemic Nber

Unemployment Benefit Replacement Rates During The Pandemic Nber

The tax refunds are expected to go out in.

2020 unemployment benefits. The 19 trillion American Rescue Plan allows those who received unemployment benefits to deduct 10200 in payments from their 2020 income. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. The stimulus law -- passed in March -- included a 10200 tax.

The new tax break is an exclusion workers exclude up to 10200. In general unemployment benefits are treated as taxable income. If you received unemployment benefits in 2020 -- and paid taxes on those benefits -- you may be due extra money from the IRS as a refund.

The IRS says up to 10200 of an individuals unemployment benefits received in 2020 is now tax-free due to the American Rescue Plan. The benefit only applies to those whose modified. To qualify for this exclusion your adjusted gross income AGI must be less than.

Doug Ducey on Monday rescinded an order he signed in. Married couples who file jointly and both collected unemployment insurance benefits in 2020 will have taxes waived on 10200 per person or up to 20400 of UI benefits. Unemployment compensation is taxable.

Signed on March 11 the American Rescue Plan exempts from federal tax up to 10200 of unemployment benefits received in 2020 20400 for married couples filing jointly for. For taxpayers who already have filed and figured their 2020. Certain taxpayers who received unemployment benefits in 2020 can now exclude up to 10200 of compensation from taxable income.

Galle notes lower income people especially stand to benefit. All other eligible taxpayers can exclude up to 10200 from their income. This law change occurred after some people filed their 2020 taxes.

In total unemployed workers will receive 39 weeks of unemployment benefits which will carry them through to the end of 2020. Americans who lost their jobs last year and have already filed their tax returns will have one less headache to deal with. The American Rescue Plan -- passed in March -- included a.

Under the American Rescue Plan Act a 10200 tax exemption was added that. The IRS may owe you an additional refund if you received unemployment benefits in 2020 and paid taxes on the benefits. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

However President Joe Bidens 19 trillion American Rescue Plan waived up to 10200 in federal taxes from the 2020. However the American Rescue Plan Act of 2021 allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. Information for people who already filed their 2020 tax return.

That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits during filing season in 2021 for 2020 tax returns. PHOENIX Arizonans are going to have to start looking for work again later this month if they want to keep their unemployment benefits. CNN In a historic expansion of unemployment insurance the federal government would give jobless workers an extra 600 a week on top of their state benefits for.

The good news is that up to 10200 of those benefits received in 2020 are tax-free thanks to the American Rescue Plan Act of 2021. The Century Foundation study estimates that the average unemployed American received 14000 in jobless benefits during 2020 so the tax exemption may drastically reduce the amount owed by many families.

U S Unemployment Rate Fell To 10 2 In July Signaling A Move From Recession To Recovery Fortune

U S Unemployment Rate Fell To 10 2 In July Signaling A Move From Recession To Recovery Fortune

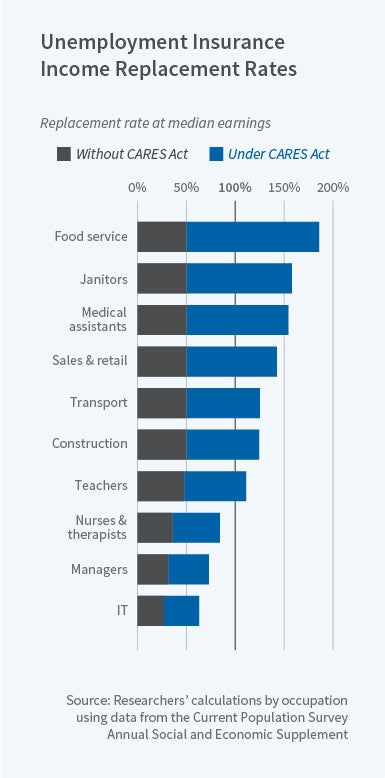

One In Four Us Workers Claiming Jobless Benefits Bbc News

One In Four Us Workers Claiming Jobless Benefits Bbc News

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits To Go Up 600 Weekly For Some

Unemployment Benefits To Go Up 600 Weekly For Some

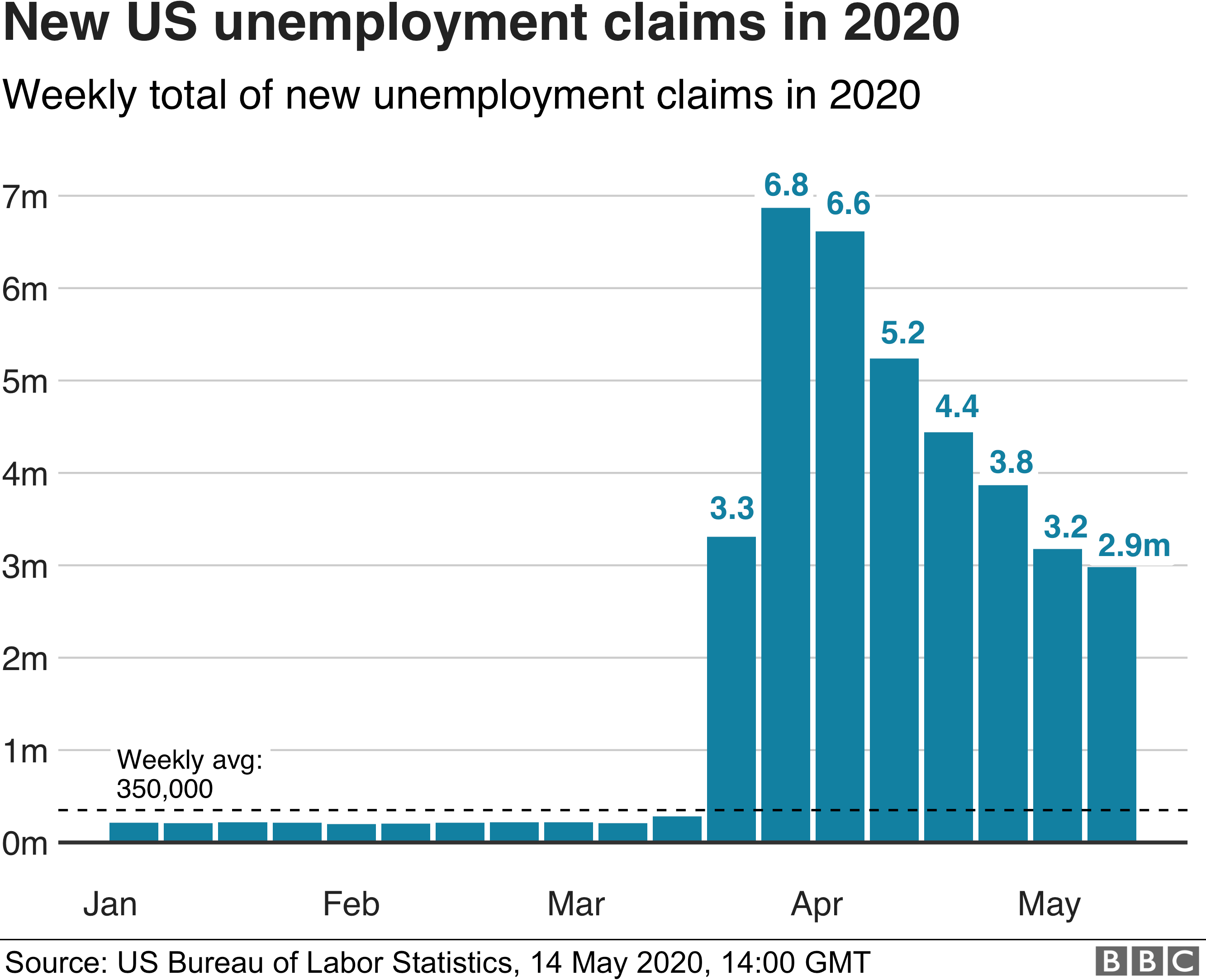

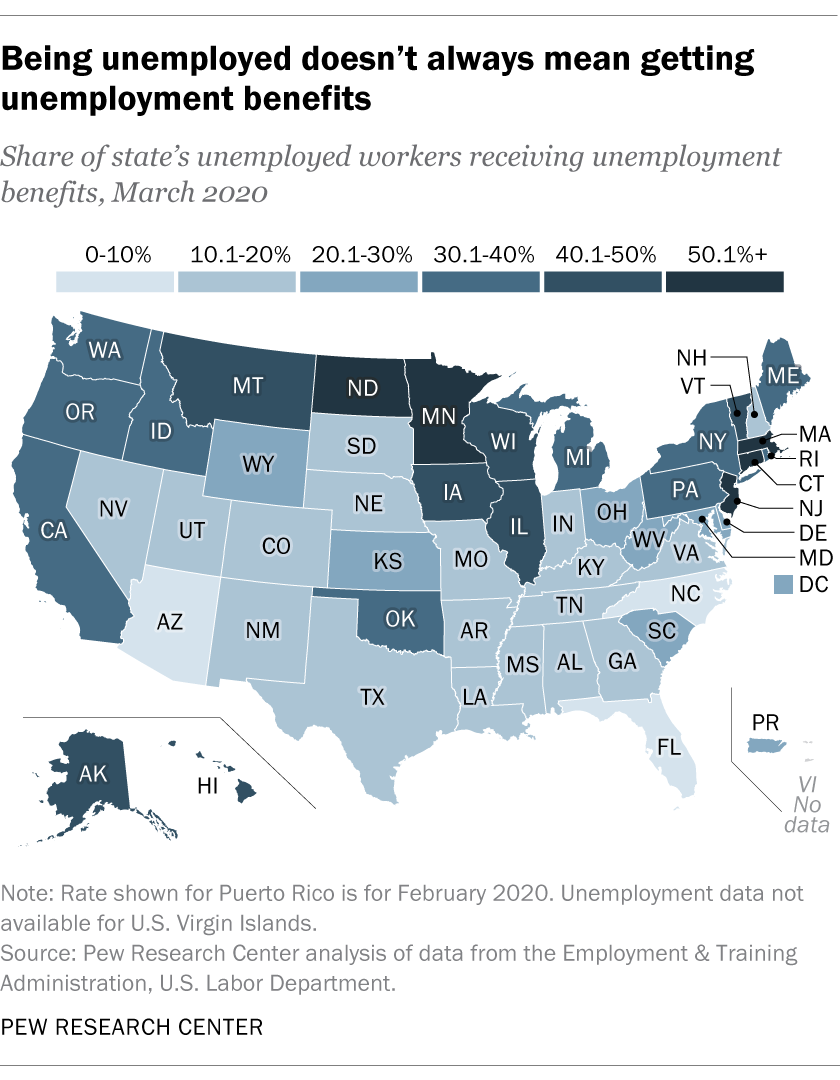

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

The 600 Unemployment Booster Shot State By State The New York Times

The 600 Unemployment Booster Shot State By State The New York Times

44 2 Million Americans Filed For Unemployment Insurance Benefits During Coronavirus Pandemic Fortune

44 2 Million Americans Filed For Unemployment Insurance Benefits During Coronavirus Pandemic Fortune

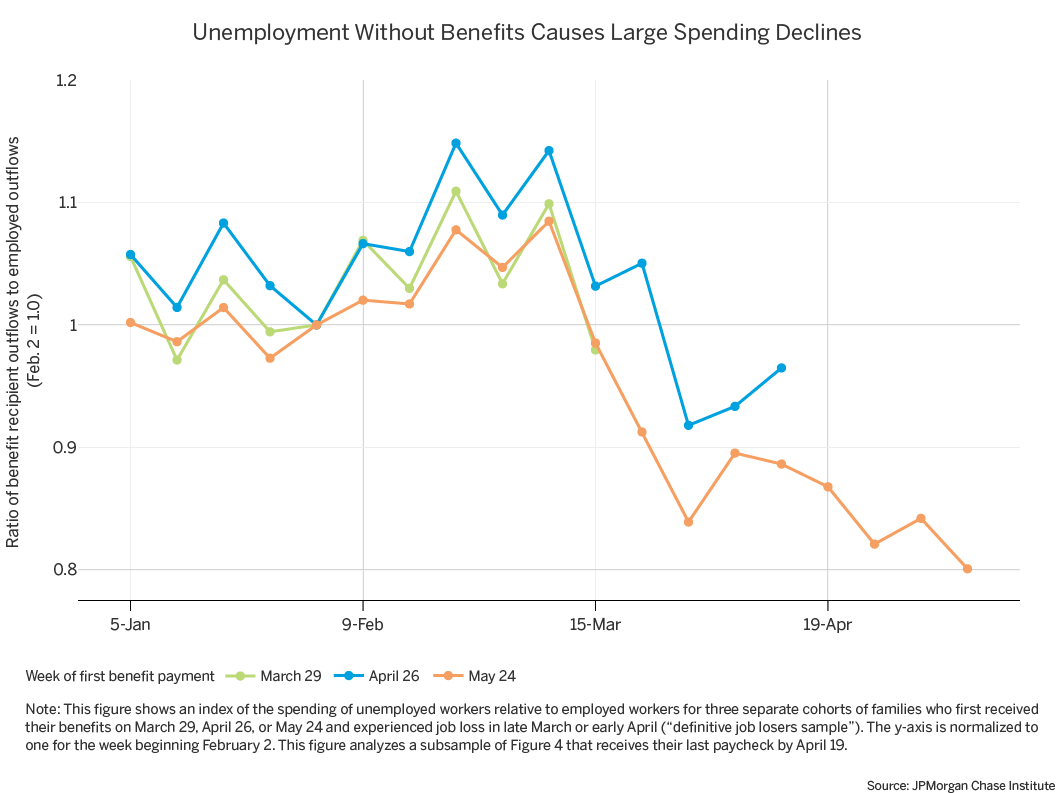

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

38 Million Have Applied For Unemployment But How Many Have Received Benefits Rand

38 Million Have Applied For Unemployment But How Many Have Received Benefits Rand

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Unemployment Benefits And Non Standard Dependent Employment Striking The Balance Between Income Security And Work Incentives Oecd Employment Outlook 2020 Worker Security And The Covid 19 Crisis Oecd Ilibrary

Unemployment Benefits And Non Standard Dependent Employment Striking The Balance Between Income Security And Work Incentives Oecd Employment Outlook 2020 Worker Security And The Covid 19 Crisis Oecd Ilibrary

File Expenditure On Unemployment Related Benefits By Detailed Benefit Type And Number Of Unemployed Persons Eu 2000 2017 Index 2000 100 Fp20 Png Statistics Explained

File Expenditure On Unemployment Related Benefits By Detailed Benefit Type And Number Of Unemployed Persons Eu 2000 2017 Index 2000 100 Fp20 Png Statistics Explained

Have Enhanced Unemployment Benefits Discouraged Work Econofact

Have Enhanced Unemployment Benefits Discouraged Work Econofact

File Expenditure On Unemployment Related Benefits Per Unemployed Person 2016 Pps Fp20 Png Statistics Explained

File Expenditure On Unemployment Related Benefits Per Unemployed Person 2016 Pps Fp20 Png Statistics Explained

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.