Second if your income. There are several exemptions from the fee that may apply to people who have no income or very low incomes.

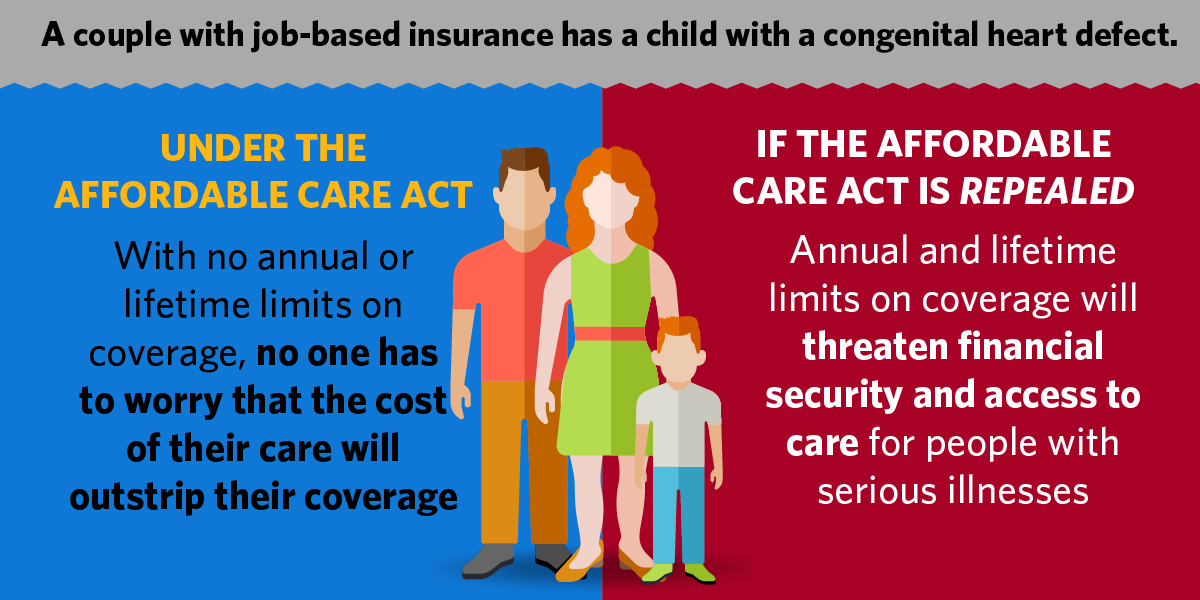

An American Life With Or Without The Affordable Care Act Whitehouse Gov

An American Life With Or Without The Affordable Care Act Whitehouse Gov

Taxes increased in 2013 for individuals making more than 200000 a year or 250000 for married couples some health care providers and other health-related businesses.

No income and obamacare. You will be asked about your current monthly income and then about your yearly income. To qualify for a subsidy your household income must be between 100 and 400 of the FPL. Medicare is for those who are 65 and older or disabled so yes you can not qualify for Medicare.

How Much Will Obamacare Cost Me If. You can however apply for an exemption for being rejected for Medicaid and use that to get a catastrophic plan. The Affordable Care Act of 2010 Obama care expands coverage for Medicaid eligible people but is not effective until January 1 2014.

However youre probably eligible for Medicaid depending. You dont have to be a US. Currently As far as income is concerned it is broken down based on the percentage of your poverty level.

Medicaid is government-run health coverage provided to people with limited incomes and the expansion of Medicaid is a major cornerstone of Obamacare. The plan you are looking at is an unsubsidized plan. Citizen to get subsidies but you do have to be in the country legally.

See our ObamaCare taxes page for a full list of taxes on high earners with a taxable income of 200000 individual 250000 family. If you make more than 200000 a year. Less Than 100 of FPL.

First you wont have to pay the tax for not having insurance. Since both terms involve health coverage health care reform and the United States federal government they. If you have no income then getting covered is free in all states that expanded Medicaid.

What if you have no income for obamacare. You have to make at least 11670 to qualify for ObamaCares Marketplace subsidies. To qualify for an Obamacare tax credit you have to estimate your household income for the following year in your application.

With or without an individual mandate that requires you to purchase health insurance you know that you and your family really should have insurance protection. Even though the mandate no longer applies there are still some taxes related to Obamacare. Reporting Health Coverage to the IRS Everyone who has to file taxes will have to at the very least report about the status of their health coverage throughout the year on their Federal Income Taxes.

Obamacare includes Health Plans Medicaid and CHIPs Obamacare Health Plans require a minimum Income Family Plans can include persons with no income Medicaid and CHIPs do not require a minimum income The Individual Mandate requires insurance but provides. That means Obamacare costs you zero. You must make your best estimate so you qualify for the right amount of savings.

Like other Americans you must have qualifying health coverage or pay a fee for plan years 2018 and earlier. But you must also not have access to Medicaid or qualified employer-based health coverage. If you are at 0 you should qualify for Medicaid.

If you are like millions of Americans you do not qualify for Medicaid but you also cant afford Obamacare. You need it to protect your financial health and your budget against the high costs of medical careboth everyday. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income.

If your household makes less than 100 of the federal poverty level you dont qualify for premium tax credits Obamacare subsidies. Your subsidy eligibility depends on your income but for 2021 and 2022 theres no longer an income cutoff at 400 of FPL. For anyone earning around 19000 subsidies will now be generous enough to sign up for a typical plan with no monthly payment.

In states that didnt you could be in the Medicaid Gap. Prior to 2020 there was no provision to allow people enrolled in plans outside of the exchange to switch to an on-exchange plan if their income changed mid-year and made them newly-eligible for premium tax credits since an income change was only considered a qualifying event if the enrollee already had a. Therefore I have looked at the exact scenario Harry outlines above.

You simply wont qualify for monthly premium assistance if you make more than the income limit. If you fall within this income range and you cant get Medicaid from your state heres what happens. Whose income to include in your estimate.

But it also depends on your access to employer-sponsored coverage or Medicaid. I can just move to an exchange plan manipulate my income down to qualify for subsidies and possibly even pay less than I do now for. Obamacare is a federal law but its also often used to refer to individual market health insurance obtained through the exchanges.

You can base this amount on your most recently filed tax return taking into account any changes you expect for the following year. You can still get Obamacare no matter how much you make per year. I Make Less Than 16753 or 34638 for a Family of Four - If your income is 138 or less of the federal poverty level you qualify for expanded Medicaid.

But many states state didnt expand Medicaid. This is true regardless of your employment status. WASHINGTON A 64-year-old woman whose 58000 income puts her out of range for subsidized health insurance through the Affordable Care Act could see her premium drop from.

When you fill out your application you must use your modified adjusted gross income MAGI. See the full list of exemptions for 2018. Marketplace savings are based on your expected household income for the year you want coverage not last years income.

Bidens health care plan would provide federal subsidies to everyone regardless of income and ensure that those enrolled in ACA coverage would pay no more than 85 of their income. If your household income is between 100 and 400 of the federal poverty guidelines and you do not qualify for Medicare Medicaid or employer-sponsored health coverage then you may qualify for a subsidy to pay some or all of the cost of health insurance purchased through an exchange. With the implementation of ObamaCare next year my plan is no longer a benefit compliant plan and the replacement options with Blue Cross will increase my current premiums by about 300.

/how-could-trump-change-health-care-in-america-495a19a0a11a48e2ad49deac0b279940.png) Donald Trump S Health Care Policies

Donald Trump S Health Care Policies

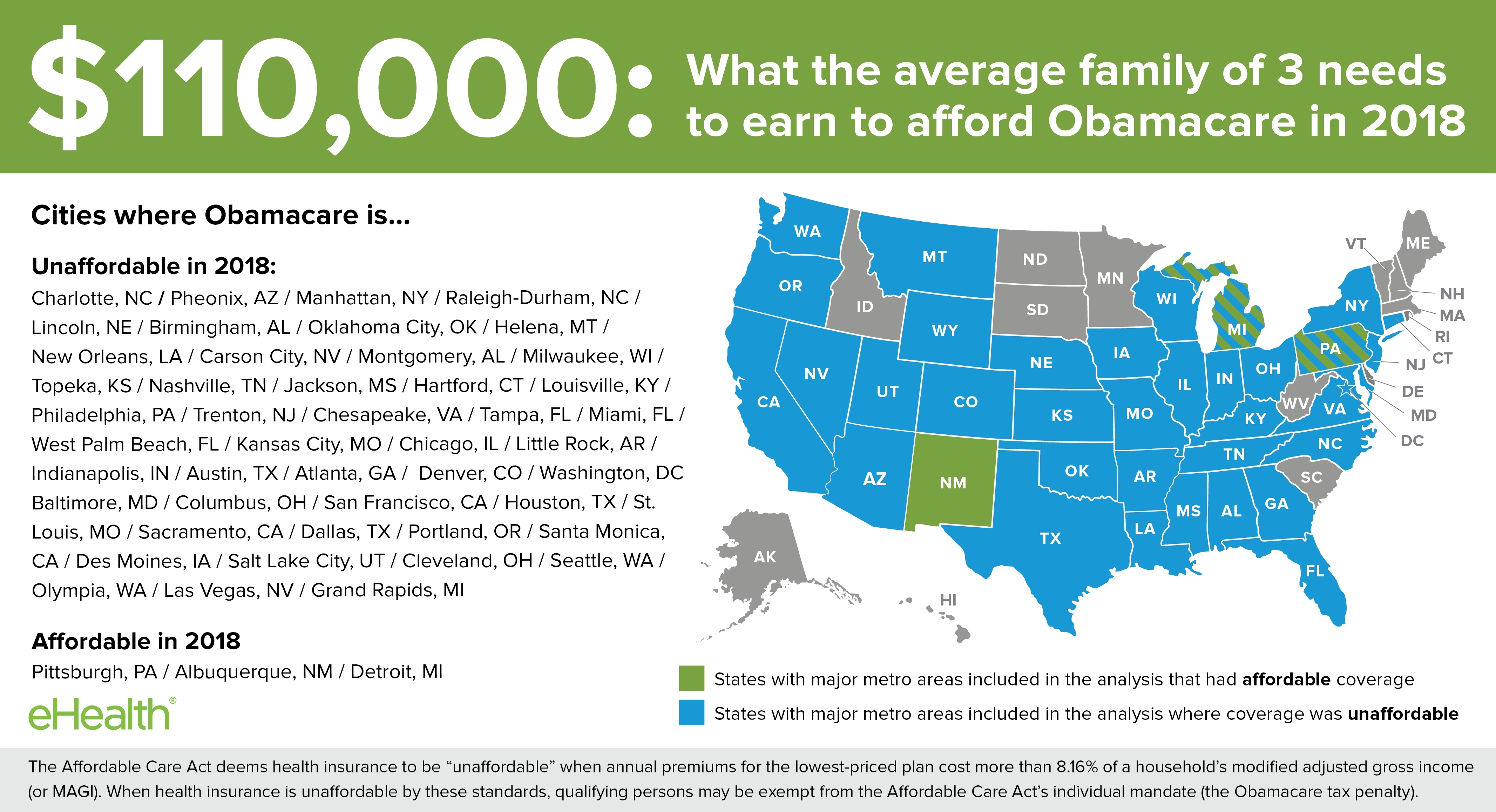

Affordable Care Act Health Insurance Will Be Unaffordable In 2018 For Many Middle Income American Families Ehealth Analysis Shows Business Wire

Affordable Care Act Health Insurance Will Be Unaffordable In 2018 For Many Middle Income American Families Ehealth Analysis Shows Business Wire

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Unemployed On Obamacare Does Withdrawls From My Ira Or 401k Count As Income Healthtn

Unemployed On Obamacare Does Withdrawls From My Ira Or 401k Count As Income Healthtn

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

:max_bytes(150000):strip_icc()/how-much-will-obamacare-cost-me-3306054-v3-5bbd183246e0fb0051d2593b.png) How Much Will Obamacare Cost Me

How Much Will Obamacare Cost Me

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

/obamacare-taxes-penalties-and-credits-3306061_FINAL2-acbc62123f0a4d59860dd165ecc6aa8d.png) Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

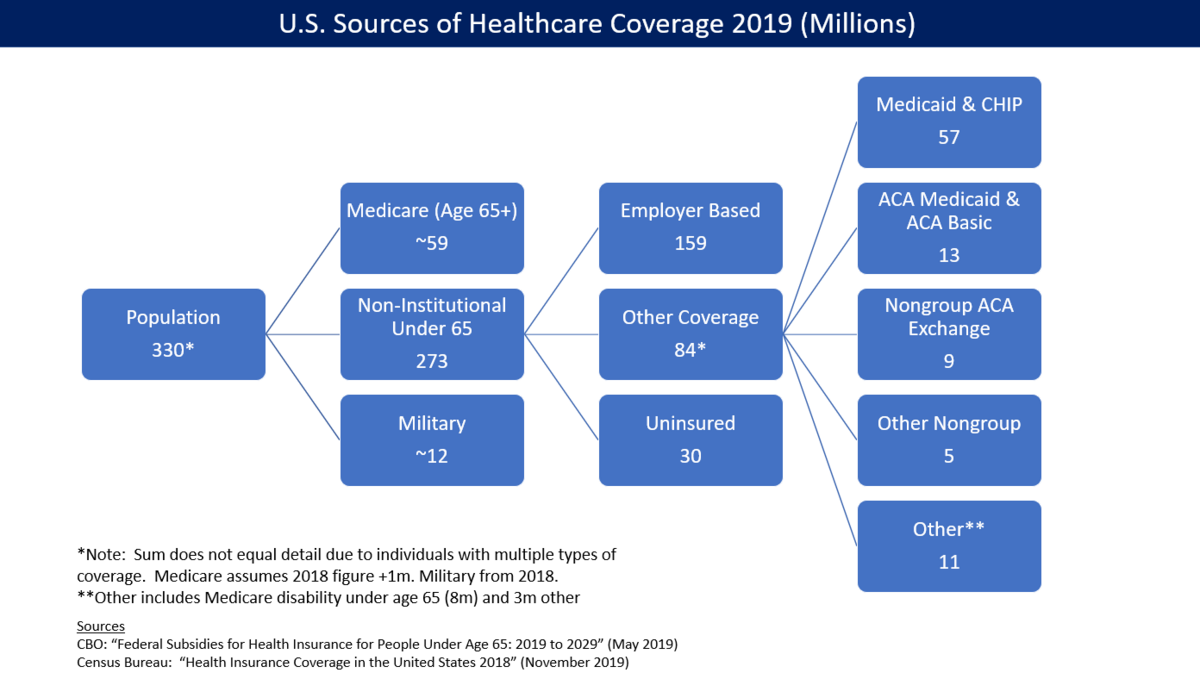

Health Insurance Coverage In The United States Wikipedia

Health Insurance Coverage In The United States Wikipedia

Obamacare Shopping Is Trickier Than Ever Here S A Cheat Sheet

Obamacare Shopping Is Trickier Than Ever Here S A Cheat Sheet

/obamacare-pros-and-cons-3306059-final-HL-75d611454d684942a27cf4463e4841a6.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.