Information held on your credit file such as loans credit cards or mortgages. Child Tax Credit is a benefit that helps with the costs of raising a child if you are on a low income.

How Will The New Child Tax Credit Payments Work Forbes Advisor

How Will The New Child Tax Credit Payments Work Forbes Advisor

Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17.

Child tax credit information. The child tax credit has helped millions of Americans with the cost of raising children. Child tax credit by the numbers. Your UK passport details.

For example if you have a. The Child Tax Credit stimulus changes include a credit amount increase for 2021 which is. Child tax credits are available for low- and moderate-income families to help offset the costs of children and for qualifying filers this can mean significant cost savings when filing your taxes.

For Tax Years 2018-2025 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500. Once the child tax credit portal is available recipients can log in to update their information if their circumstances have changed. The Child Tax Credit is intended to offset the many expenses of raising children.

The American Rescue Plan Act of 2021 recently increased the amount of the Child Tax Credit for most taxpayers from 2000 to 3000 for the 2021 taxable year only. However it is being replaced by Universal Credit so people who need help with these costs now have to make a claim for Universal Credit instead. Your tax credit claim details.

However in some instances individuals can claim the additional child tax credit which is a refundable tax credit. You can only make a claim for Child Tax Credit if you already get Working Tax Credit. The Child Tax Credit is a refundable tax credit of up to 3600 per qualifying child under 18.

The credit begins to phase out when adjusted gross income reaches 75000 for single filers 150000. Age Test - To qualify a child. It only applies to dependents who are younger than 17 as of the last day of the tax year.

Qualification - A qualifying child for this credit is someone who meets the qualifying criteria of six tests. Length of residency and 7. Part of this credit can be refundable so it may give a taxpayer a refund even if they dont owe any tax.

A child tax credit CTC is a tax credit for parents with dependent children given by various countries. We now have a new federal tax plan and one of the biggest benefits to the Trump Tax changes is that the child tax credit has been changed from a non-refundable credit to giving you up to 1400 refundable credit. One of your 3 most recent payslips.

In the case of a qualifying child who has not attained the age of 6 as of the close of the calendar year the credit is increased to 3600. 3000 for each qualifying child aged six through 17 previously 2000 17-year-old children are now eligible for the credit previously only children under age 17 qualified 3600 for each qualifying child under the age of six previously 2000. When families file their 2021 tax return that is the return due in April 2022 they will receive a 3000 tax credit for each qualifying child including 17-year-olds.

The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. IRS Tax Tip 2020-28 March 2 2020. You andor your child must pass all seven to claim this tax credit.

This means that the tax credit can only offset tax liability to 0 but any excess will not be refunded to the individual. At a basic level the child tax credit is a credit that parents and caregivers can claim to help reduce their tax bill depending on the number and ages of their dependents. The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get.

Generally the Child Tax Credit is a non-refundable credit. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. Ten Facts about the Child Tax Credit Amount - With the Child Tax Credit you may be able to reduce your federal income tax by up to 1000 for each.

The taxpayers qualifying child must have a Social. Enacted in 1997 the credit was established through the Taxpayer Relief Act. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level.

For example in the United States only families making less than 400000 per year may claim the full CTC. If you cannot apply for Child Tax Credit you can apply. If youre a taxpayer who.

This page tells you more about how Child Tax Credit is affected by Universal. The Child Tax Credit can be worth as much as 2000 per child for Tax Years 2018-2025.

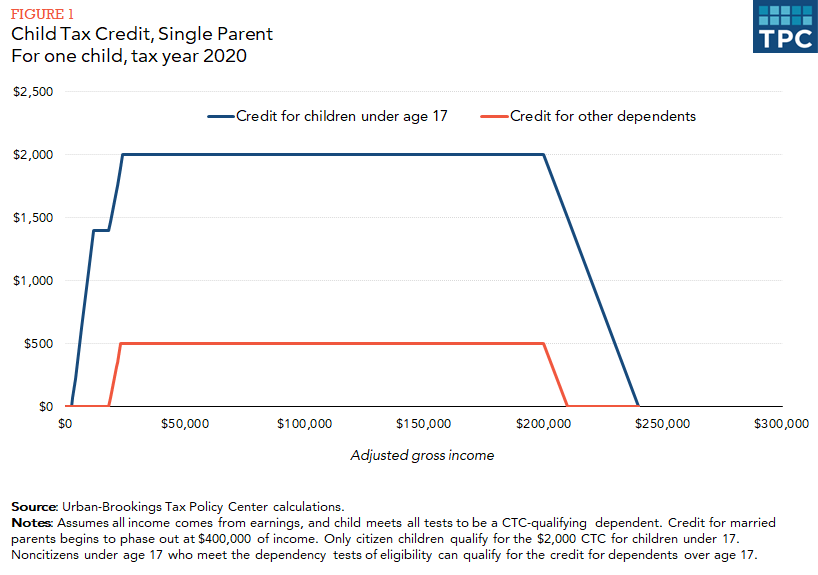

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

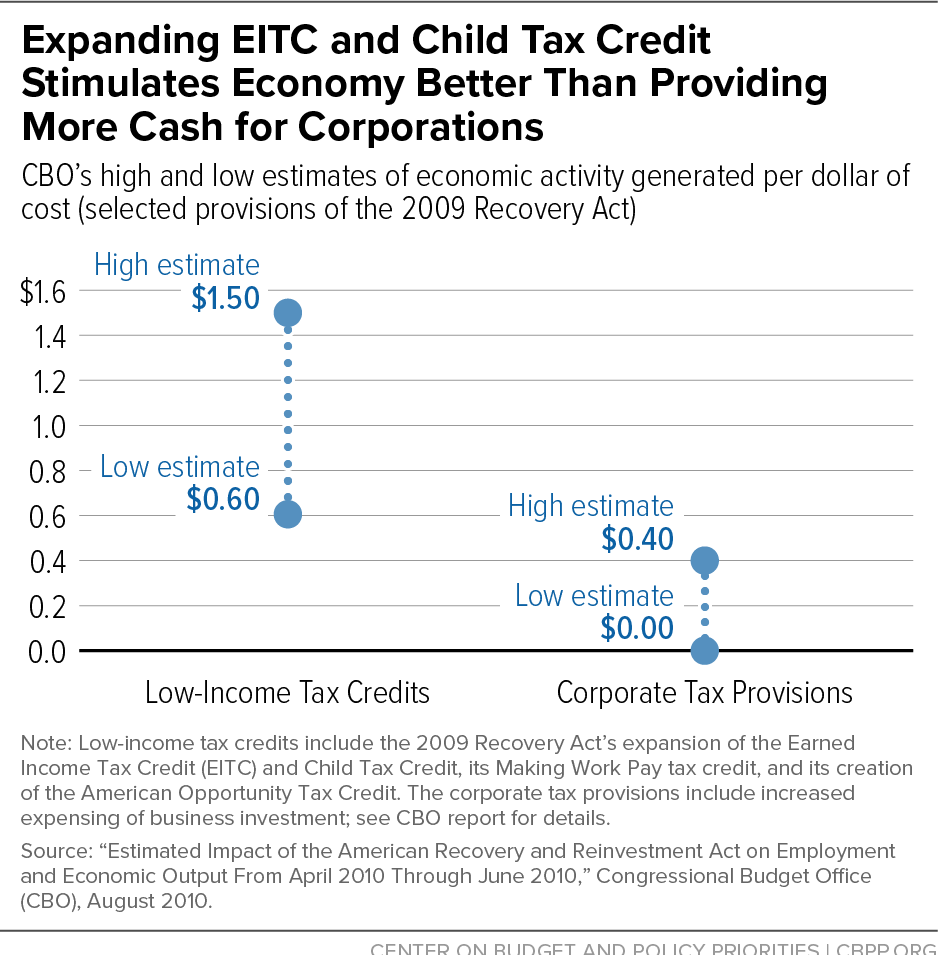

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

A New Child Tax Credit Would Put Us On The Road To A Stronger New Mexico New Mexico Voices For Children

A New Child Tax Credit Would Put Us On The Road To A Stronger New Mexico New Mexico Voices For Children

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

Claiming The Child Tax Credit Everything You Need To Know In 2021

Claiming The Child Tax Credit Everything You Need To Know In 2021

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Claiming The Child Tax Credit Abroad Expat Tax Cpa S

Claiming The Child Tax Credit Abroad Expat Tax Cpa S

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png) Can You Claim A Child And Dependent Care Tax Credit

Can You Claim A Child And Dependent Care Tax Credit

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

What Is Child Tax Credit Low Incomes Tax Reform Group

What Is Child Tax Credit Low Incomes Tax Reform Group

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.