Farm Structures and Other Improvements. Keep this in mind when house hunting.

North Dakota Property Tax Relief Probably Won T Last Say Anything

North Dakota Property Tax Relief Probably Won T Last Say Anything

While this page shows statewide North Dakota property tax statistics more precise property tax statistics can be found at county level.

North dakota property tax. Assessment of Railroad Property. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of. Statewide the effective property tax is 105 which puts North Dakota 24th in the country.

Mobile Home tax statements are also mailed in December. County Board of Equalization. You can also receive your property tax notices through email.

In Richland County property taxes on a 250000 home would be 3720 but in Cass County youd pay 4073. Overview of North Dakota Taxes. The average effective property tax rate across North Dakota is 099.

By NDCC they must be mailed by the 26th of December. Counties in North Dakota collect an average of 142 of a propertys assesed fair market value as property tax per year. Improvements to Commercial and Residential Buildings.

Find tax information laws forms guidelines and more. With electronic notices you dont have to worry about losing paper. North Dakota Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in ND.

Assessment and Taxation of Public Utilities. Taxation Chapter Section Listing Chapter Name. North Dakota Legislative Branch.

Sign up for electronic tax notices. Dakota County sends every property owner a Property Tax Statement every March. Property Tax Credit for Disabled Veterans.

North Dakota has a total of fifty three counties and each county has a unique process for assessing and calculating property tax. Thats slightly below the national average of 107 but its considerably lower than the effective rate in South Dakota which is 122. This statement outlines what is owed in property taxes for the year.

State Board of Equalization. 701-456-7634 Pay Taxes Online- ITax Website. Property Tax Revolution - North Dakota.

Median Property Taxes Mortgage 2102. 57-02-04 and 57-02-08 For Individuals. Monday - Thursday - 800 AM 500 PM Mountain Time Friday - 800 AM - 1200 PM Mountain Time Closed Legal Holidays Physical Address.

Exemption of Improvements to Buildings. North Dakota Property Tax Payments Annual North Dakota United States. Township Board of Equalization.

51 3rd Street East Dickinson ND 58601 Stark County Courthouse 1st Floor Mailing Address. Because of these county variations you could pay more in taxes for the same house in a different area. If playback doesnt begin shortly try restarting your device.

North Dakota Property Taxes By County. A 5 discount is given on the consolidated tax if paid by February 15th of each year. The first half of taxes is due in May while the second half is due in October.

Pay Property Tax Online. City Board of Equalization. The North Dakota Office of State Tax Commissioner is the government agency responsible for administering the tax laws of North Dakota.

Property Taxation - NDCC Chapters 57-02 through 57-35 and 57-55. Land owned or leased by the North Dakota Game and Fish Department Land owned by the Board of University and School Lands Land owned by the North Dakota National Guard Farmland or. North Dakota State Property Tax Exemptions httpswwwndgovtaxuserindividualsforms--publicationsproperty-taxforms--instructions View North Dakota property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details.

Property Tax Credits for North Dakota Homeowners and Renters. 142 of home value. Tax amount varies by county.

Real Estate tax statements are mailed each December. North Dakota Property Tax Law Regulations Law. Tax Records include property tax assessments property appraisals and income tax records.

The median property tax in North Dakota is 165800 per year for a home worth the median value of 11680000. Median Property Taxes No Mortgage 1450. Payments in Lieu of Real Estate Taxes.

Questions on paying your taxes online please contact. The following property is subject to payments in lieu of taxes. If you would like to estimate the property tax on a home like yours in North Dakota.

North Dakota exempts all personal property from property taxation except that of certain oil and gas refineries and utilities. Action by County to Quiet Title. Homestead Credit for Special Assessments.

Property Exempt From Taxation. PO Box 130 Dickinson ND 58602-0130 Phone. North Dakota Century Code.

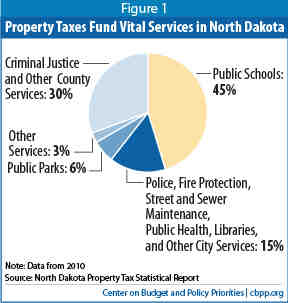

North Dakota S Measure 2 High Risk For Little Reward Center On Budget And Policy Priorities

North Dakota S Measure 2 High Risk For Little Reward Center On Budget And Policy Priorities

Voters May Be Asked To Abolish Nd Property Tax Knox News Radio Local News Weather And Sports

Voters May Be Asked To Abolish Nd Property Tax Knox News Radio Local News Weather And Sports

North Dakota Property Tax Mend It Don T End It

North Dakota Property Tax Mend It Don T End It

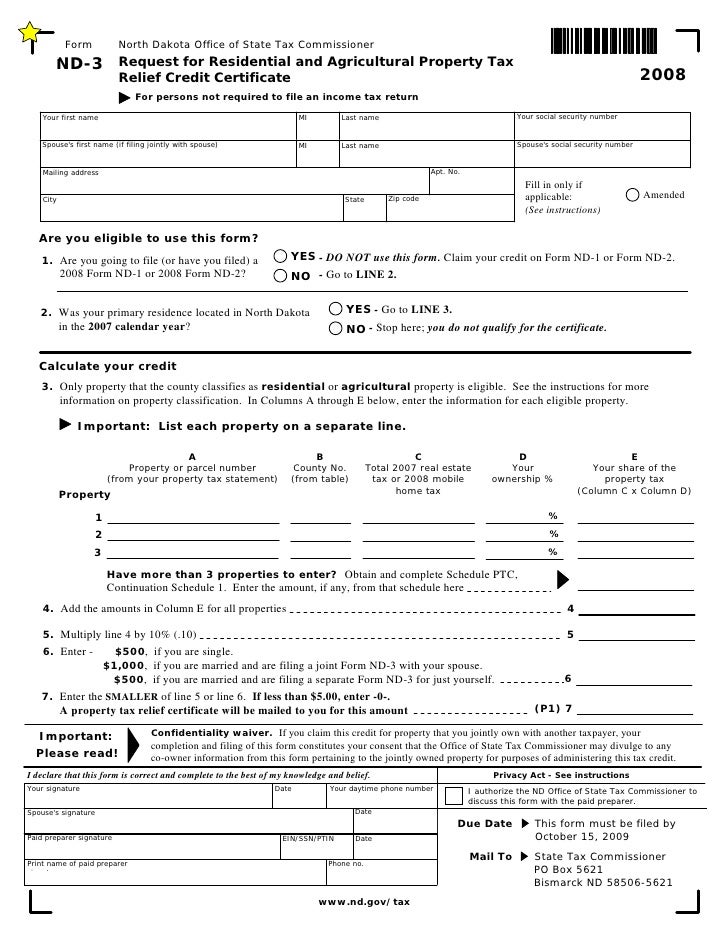

2008form Nd 3 Enabled Nd Gov Tax Indincome Forms 2008

2008form Nd 3 Enabled Nd Gov Tax Indincome Forms 2008

Majority Turns Back Effort To Abolish Property Taxes In North Dakota Csg Knowledge Center

Majority Turns Back Effort To Abolish Property Taxes In North Dakota Csg Knowledge Center

Economic Development And Finance Property Tax Exemption

Economic Development And Finance Property Tax Exemption

North Dakota Considers Eliminating Property Tax

North Dakota Considers Eliminating Property Tax

North Dakota Property Tax Rate Nd Personal Property Tax

North Dakota Property Tax Rate Nd Personal Property Tax

North Dakota Property Tax Remains After Vote Time Com

North Dakota Property Tax Remains After Vote Time Com

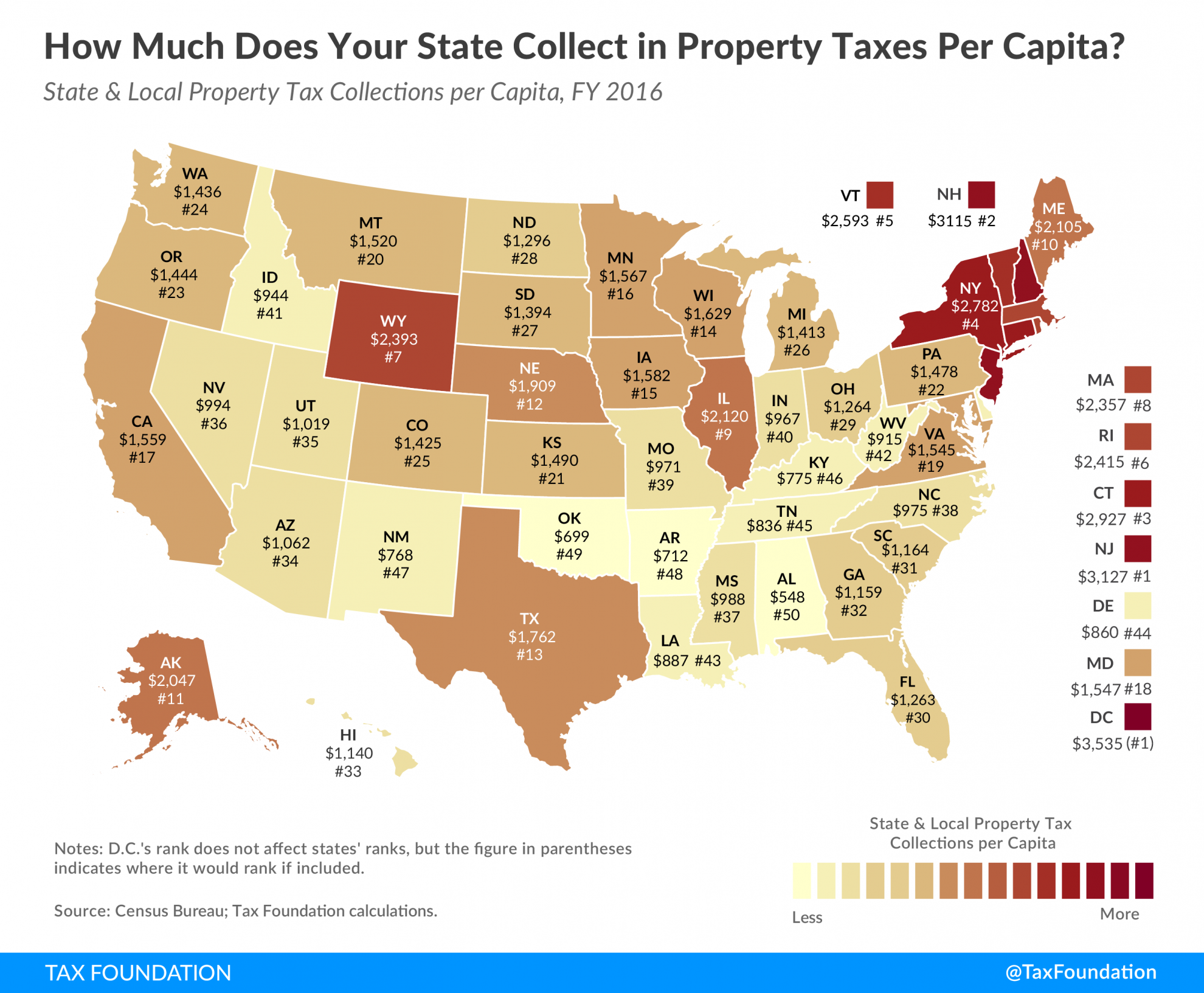

Property Taxes Per Capita State And Local Property Tax Collections

Property Taxes Per Capita State And Local Property Tax Collections

North Dakota Property Tax Calculator Smartasset

North Dakota Property Tax Calculator Smartasset

There S An Appetite For Eliminating Property Taxes In North Dakota The Minuteman Blog

There S An Appetite For Eliminating Property Taxes In North Dakota The Minuteman Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.