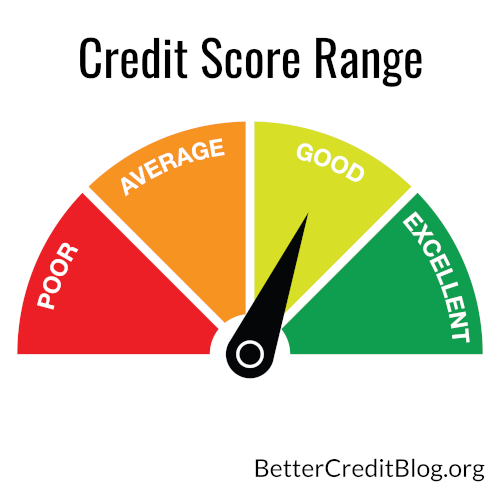

Each credit agency provides you with a credit score and these three scores combine to create both your 569 FICO Credit Score and your VantageScore. The good news is that theres plenty of opportunity to increase your score.

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

If you have a credit score of 560 you have whats considered poor credit and are in need of credit repair ASAP.

569 credit score. With a Poor score its harder to obtain credit cards loans and favorable interest rates. A credit score of 569 is considered poor however it will still get you an auto-loan some types of credit cards a home loan and even a personal loan especially from online lenders. For borrowers with a credit score between 500-579 you may still qualify for an FHA loan but will be required to put 10 down.

What does a Equifax FICO score of 569 mean. A credit score also known as a FICO Score is a number that summarizes your credit risk based on a snapshot of your credit report at a particular point in time. A 569 FICO score is basically a glass half empty glass half full debate.

Forest Park - 553. Union City - 569. A 600 FICO Score is below the average credit score.

Peachtree City ranked in the 88th percentile with an average. How to improve your 569 Credit Score. Your score falls within the range of scores from 580 to 669 considered Fair.

A smart way to begin building up a credit score is to obtain your FICO Score. While a 560 credit score to 569 are considered on the border of fair and bad credit that does not mean that there are no opportunities for you to qualify for a loan and improve your credit. The bad news about your FICO Score of 569 is that its well below the average credit score of 704.

Not every city in Georgia fell to the bottom of the pack. The most common type of loan available to borrowers with a 569 credit score is an FHA loan. Some lenders see consumers with scores in the Fair range as having unfavorable credit and may decline their credit applications.

If youre going to apply for loans make sure the monthly payments are reasonable. College Park - 564. Along with the score itself youll get a report that spells.

Of course any unsecured consumer personal loan with a credit score in the 560s is going to have an extremely high APR interest rate. Ultimately it depends on the lender. A 569 FICO Score is considered Poor.

The effects can really take a toll on a persons life and it might be worse than you think. Keep in mind that in order to qualify for a 35 down payment you must have at least a 580 credit score. Different ways of asking the same question.

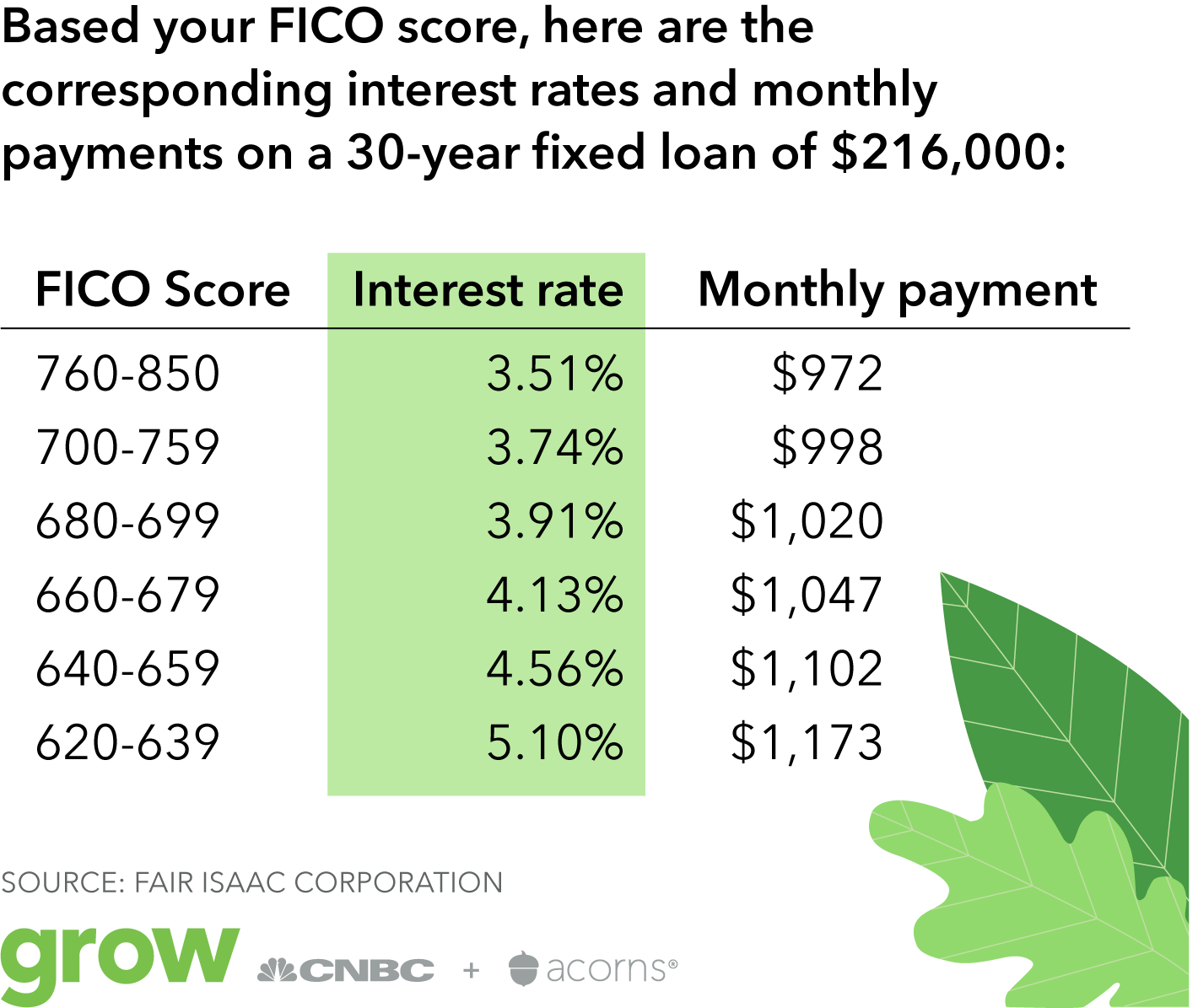

The score however will impact your finances negatively as your credit report will indicate to the lenders that you have a high risk of defaulting your debt. Conventional mortgage lenders will most likely decline your application with a credit score of 569 as the minimum credit score is around 620. Some lenders might see that youre half way to bad credit or half way to fair credit.

91 of consumers have FICO Scores higher than 569. FHA World - CREDIT SCORE. As a general rule credit scores below 619 receive the worst interest rates on home loans auto loans and credit.

It is 131 points away from being a good credit score which many people use as a benchmark and 71 points from being fair. Credit scores are used by lenders to help them estimate the possibility of. A credit score of 569 indicates that youve got some work ahead.

A 569 credit score is classified as bad on the standard 300-to-850 scale. A credit score helps lenders. However you must understand how a FICO score is calculated before you can label a particular number as good or bad.

Your score will differ slightly among each agency for many reasons including their unique scoring models and how often they access your financial data. At this level the best thing you can do is focus on raising that number. Nothings impossible but its also not easy.

But there is a chance. It means youve had past payment problems including collection accounts judgments bankruptcy or worse. There are fewer lenders that will allow 620 credit score and fewer that allow credit score down to 580.

If your credit score is below 580 then a 100 down payment is required for a purchase and a maximum of 90 LTV for a rate and term refinance. However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of. Lets face it a credit score between 560 and 569 is bad and it is going to be challenging to find many lenders who will give you a personal loan.

Most lenders require a 640 credit score.

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

Is A 560 Credit Score Good Or Bad See Your Loan Options

Is A 560 Credit Score Good Or Bad See Your Loan Options

569 Credit Score Is It Good Or Bad What Does It Mean In 2021

569 Credit Score Is It Good Or Bad What Does It Mean In 2021

Mid Score From 569 To 690 Repair My Credit Now

Mid Score From 569 To 690 Repair My Credit Now

569 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

569 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

How To Fix A Bad 300 560 Credit Score Mybanktracker

How To Fix A Bad 300 560 Credit Score Mybanktracker

The Credit Score You Need To Get The Best Rate On A Mortgage

The Credit Score You Need To Get The Best Rate On A Mortgage

Best Personal Loans For 569 Credit Score Creditscoregeek

Best Personal Loans For 569 Credit Score Creditscoregeek

Car Leasing With A 569 Credit Score Creditscorepro Net

Car Leasing With A 569 Credit Score Creditscorepro Net

569 Credit Score Is It Good Or Bad What Does It Mean In 2021

569 Credit Score Is It Good Or Bad What Does It Mean In 2021

What Your Credit Score Range Means Improve Your Credit Score In 2021

What Your Credit Score Range Means Improve Your Credit Score In 2021

589 Credit Score Is It Good Or Bad

589 Credit Score Is It Good Or Bad

Credit Score Range An Evergreen Guide Credit Repair Expert

Credit Score Range An Evergreen Guide Credit Repair Expert

How Do You Check Your Credit Score Experian

How Do You Check Your Credit Score Experian

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.