The lenders credit wont matter in this situation. That leads to the question are refinance costs tax-deductible.

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

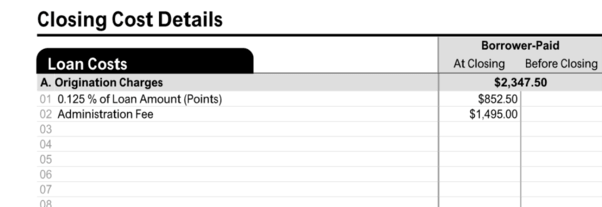

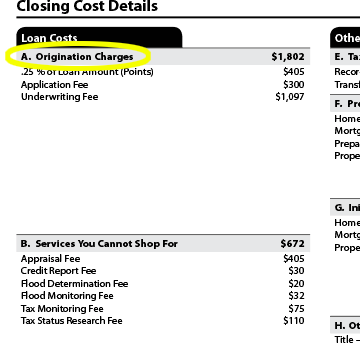

You may see the points named origination fee discount points or a loan discount.

Refinance origination fee tax deductible. Given all of its benefits. Are Loan Origination Fees Tax Deductible For a Business. IRS TAX TIP 2003-32 REFINANCING YOUR HOME Taxpayers who refinanced their homes may be eligible to deduct some costs associated with their loans according to the IRS.

Tax Deductions for Refinance and Closing Fees. People often make the mistake of thinking that the points and fees paid on a refinance are tax deductible just as they may have been when they originally obtained. On a refinance you may need to amortize an origination fee if paid over the life of the loan.

What refinance costs are tax deductible. If you opt for a cash-out refinance the qualifications are a little different. You have to pay the fees to close your loan and they will not lower your tax liability.

Keep reading to learn about what fees you can deduct and which ones you cannot. The software will prompt you to select that. The loan is for your primary residence or a second home that you do not rent out.

In short yes some refinance costs are tax-deductible but not all of them. You can deduct points paid for refinancing generally only over the life of the new mortgage. The loan is secured by your home.

The following refinance costs are tax-deductible on a residential refinance. Loan origination fee tax deductible refinance. With any mortgageoriginal or refinancedthe biggest tax deduction is usually the interest you pay on the loan.

Points paid to obtain an original. However if you use part of the refinanced mortgage proceeds to improve your main home and you meet the first six requirements stated above you can fully deduct the part of the points related to the improvement in the year you paid them with your own funds. 24400 for married couples filing jointly.

Generally for taxpayers who itemize the points paid to obtain a home mortgage may be deductible as mortgage interest. Other costs are added to your basis in the property. Fortunately the IRS considers both discount points and loan origination fee points as pre-paid interest which means you can write off the points as mortgage insurance.

There is some good news though. The IRS considers mortgage points to be charges paid to take out a mortgage. To save the most money on your annual tax return youll want to choose the deduction method thats most valuable to you.

You can deduct some of your other closing costs but only if you itemize deductions on Schedule A. However businesses often pay at a rate of 1 to 6. Refinancing your mortgage may be a smart move but its not much of a tax loophole.

As explained in IRS Publication 936 points are tax deductible but other loan origination fees are not. Taking Tax Deductions When it comes to writing off points you have two optionsyou can write them off over the course of the loans duration or you can write them off all at once in the year that you bought the home. Most of your refinancing fees -- appraisal inspection loan origination -- dont give you any sort of write-off.

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos. Are refinancing costs tax-deductible. Generally mortgage interest is tax deductible meaning you can subtract it from your income if the following applies.

If you pay points on your mortgage they may be deductible. The terms points and origination fees are interchangeable when it comes to deductibility. Loan origination fees are charged at a rate of 05 to 1 of the loan value.

Are loan origination fees tax deductible on a refinance. It is considered to be a type of interest that is deductible ONLY if it is based on a percentage of the loan value. Certain refinancing and mortgage costs are deductible.

Your origination fee is deductible but for a refinance they have to be spread out over the term of the loan. The 2019 standard deduction is. Basically what it does is cover the current out of pocket costs so.

For a refinance mortgage interest paid including origination fee or points real estate taxes and private mortgage insurance subject to limits are the only deductible fees. These other fees include preparation costs notary fees property taxes appraisal fees and mortgage insurance premiums. Refinancing your mortgage can be an excellent way to save money on your payments take cash out of your property or both.

12200 for single filers. 163 - 7 c which provides for the deduction of a repurchase premium.

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

5 Types Of Tax Deductible Closing Costs Forbes Advisor

5 Types Of Tax Deductible Closing Costs Forbes Advisor

What Is A Mortgage Origination Fee Nerdwallet

What Is A Mortgage Origination Fee Nerdwallet

Are Closing Costs On A Refinance Tax Deductible Irrrl

Are Closing Costs On A Refinance Tax Deductible Irrrl

Refinancing 101 Are Refinance Costs Tax Deductible Lowermybills

Refinancing 101 Are Refinance Costs Tax Deductible Lowermybills

How To Claim Refinance Tax Deductions Rocket Mortgage

How To Claim Refinance Tax Deductions Rocket Mortgage

Are Loan Origination Fees Tax Deductible On A Refinance Tax Walls

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Deduction Itemized Deductions Houselogic

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Are Loan Origination Fees Tax Deductible On A Refinance Tax Walls

Are Loan Origination Fees Tax Deductible On A Refinance Tax Walls

Can You Deduct Va Refinance Mortgage Closing Costs On Your Taxes Irrrl

Can You Deduct Va Refinance Mortgage Closing Costs On Your Taxes Irrrl

Are Loan Origination Fees Tax Deductible On A Refinance Tax Walls

Are Loan Origination Fees Tax Deductible On A Refinance Tax Walls

Are Loan Origination Fees Tax Deductible On A Refinance Tax Walls

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.