Thats a difference of 2834 in favor of the 529 plan. Its important to weight the pros and cons of each before deciding.

College Savings Basics The Coverdell Esa Saving For College Education Savings Account College Savings Plans

College Savings Basics The Coverdell Esa Saving For College Education Savings Account College Savings Plans

November 20 2018.

529 vs savings account. While any amount of college savings is better than none there are several key differences between these two types of college savings accounts. General savings plans and prepaid tuition plans. Type of Account There are two basic types of 529 plans.

This account is specifically earmarked to pay for qualified educational expenses. The Education Savings Account ESA and a 529 plan. A 529 plan is the most common way to save for college.

529 Plans are great savings vehicles for college after all thats what they were created for but there may be better options. The most common options are either a 529 plan or a taxable account. Pros and cons of a 529 plan.

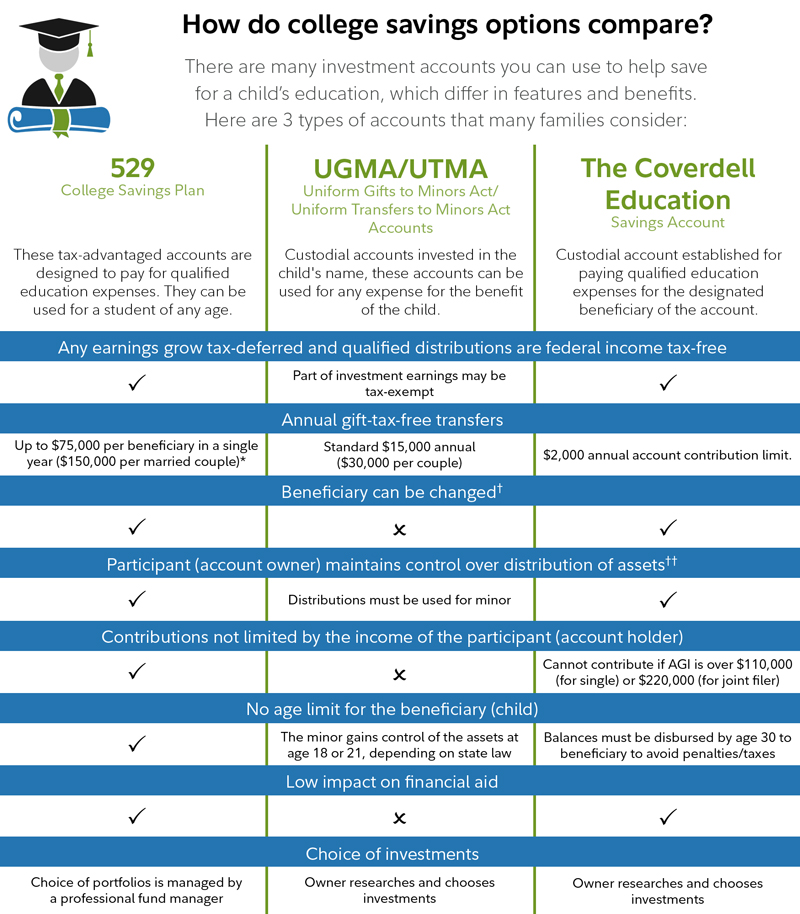

When shopping for a 529 account youll need to make a couple of big decisions on your way to selecting a plan. Unearned income above 2200 is taxed at the rates for the childs parents which may be higher than the childs rate. All 50 states offer at least one 529 plan.

These differences affect how the account is opened how funds grow and how the money may be. Or start both in order to cover all your childs education expenses. For 2021 and 2020 you can contribute up to 6000 a year 7000 if youre age 50 or older to a.

How 529 Savings Plans Work. Ultimately the winner of the 529 plan vs savings account debate is up to you. Childrens Savings Accounts CSAs and 529 college savings plans both help families save for a childs college education.

The money you contribute to your account. UGMAs and UTMAs have fewer tax advantages than 529 plans. Unlike regular savings accounts money withdrawn from a 529 plan is tax-free including any interest it has accumulated.

Contributions to a 529 plan cannot be deducted from your federal income tax. What Is a 529 Plan. Rather than simply earning interest money added to a 529 plan can be invested typically in mutual funds although some plans may also offer exchange-traded funds or individual stocks.

Parents or grandparents pick one of those plansit doesnt have to be the one in your home statechoose a beneficiary and start saving. W hichever you choose dont sacrifice your own retirement for a childs education. If the money is used for education youll have 34534 available in the 529 plan and 31700 in the brokerage account.

529 plans work a lot like mutual funds. By comparison Coverdell assets amounted to relatively paltry 7 billion. If the money is not used for education youll still have 31700 available in the brokerage account but youll only have 30427 available in the 529 plan.

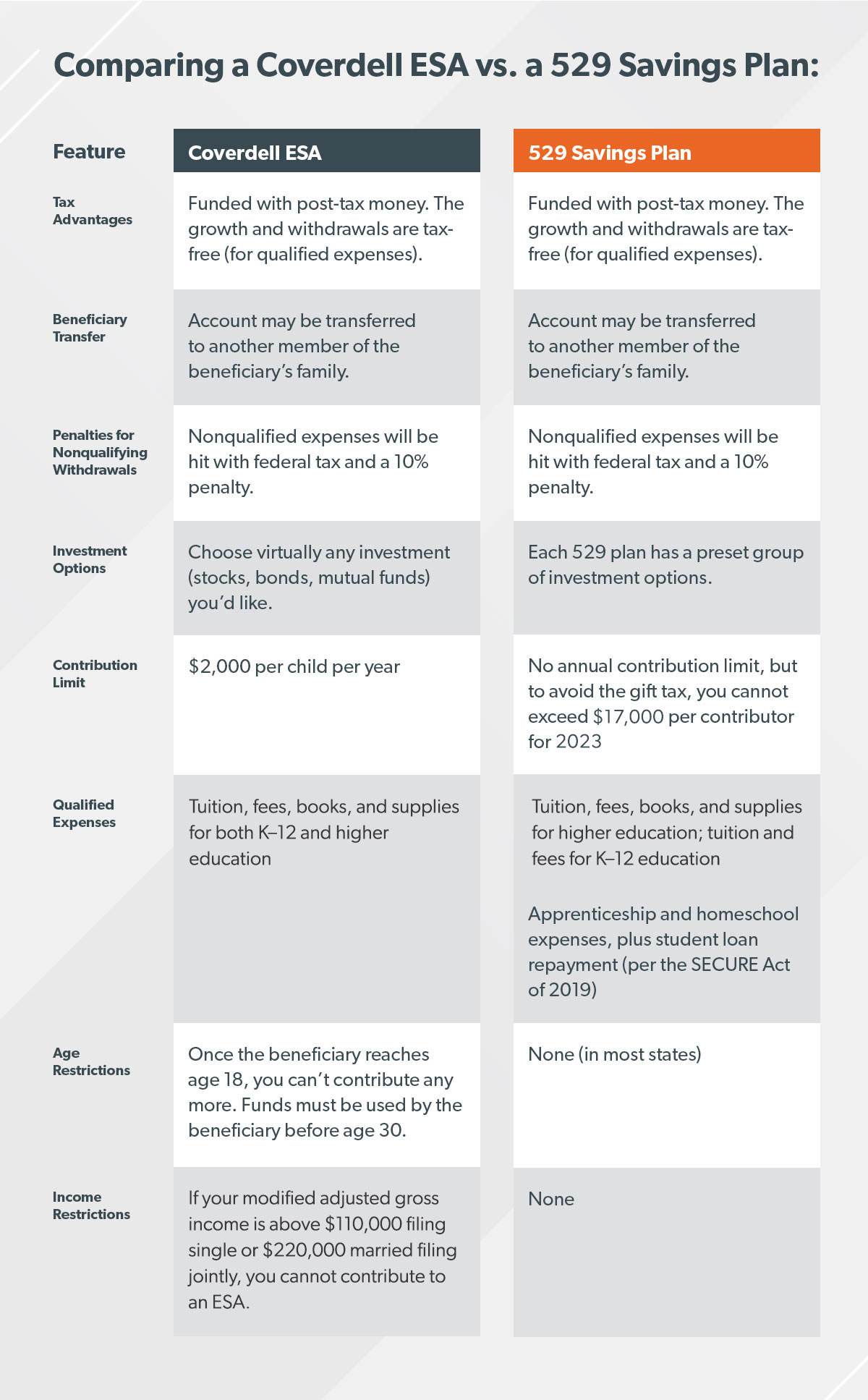

Comparing a Coverdell Education Savings Account to a 529 college savings plan might seem like putting a Big Wheel up against a Harley Davidson. While 529 plans are popular for their tax breaks and concrete certainty savings plans are also a great option for their flexibility and power of oversight. A 529 plan isnt as flexible as an UTMA account but it offers advantages around taxes and financial aid.

Most plans do a pretty good job of managing your money. A savings plan simply allows the parent to put aside money for any college expenses whereas. According to the Investment Company Institute 529 plan assets totaled more than 224 billion in 2014.

Some states plans may operate differently but most invest your money in stocks and bonds in the hope that it will grow faster than a regular bank savings account. The list of qualified educational expenses is long but the most relevant are tuition and fees including. In case of a financial emergency the funds in the private account can be reallocated to help keep as a family confronts more pressing needs.

Generally the first 1100 of annual unearned income is tax-free and the next 1100 is taxed at the childs tax rate. A Roth IRA provides more flexibility but with stricter contribution limits. But first lets make sure you understand the features of each plan.

The account options vary depending on your income and your familys needs but in this article well compare the features of the two most common. The first is whether to go with an education savings plan or a prepaid tuition plan. 529 savings plans and Roth IRAs are both tax-advantaged options to save for college.

529 plans and custodial accounts are two common college savings vehicles but they have some significant differences. A major reason for the popularity of 529 savings plans is their tax advantages. Tax benefits but fewer spending options.

A 529 plan is not the same as a traditional savings account.

Why A 529 College Savings Plan T Rowe Price

Why A 529 College Savings Plan T Rowe Price

How To Set Up A College Savings Plan For Your Kids Peace Of Mind Challenge Part 2 The Many Little Joys

How To Set Up A College Savings Plan For Your Kids Peace Of Mind Challenge Part 2 The Many Little Joys

Esa Vs 529 Which Is Right For Your Family Farm Bureau Financial Services

Esa Vs 529 Which Is Right For Your Family Farm Bureau Financial Services

How To Maximize College Savings With A Savvy 529 Plan

How To Maximize College Savings With A Savvy 529 Plan

Best Way To Invest In 529 Plans Invest Walls

Best Way To Invest In 529 Plans Invest Walls

Astute Savers Don T Just Use 529 Plans For College Savings

A Financial Aid Counseling And Literacy What Is A 529 Savings Plan

A Financial Aid Counseling And Literacy What Is A 529 Savings Plan

The Abcs Of A 529 Savings Account Gwell

The Abcs Of A 529 Savings Account Gwell

Pay For College Your College Saving Options

Pay For College Your College Saving Options

529 Plans 529 College Savings Plans What Is A 529 Plan

529 Plans 529 College Savings Plans What Is A 529 Plan

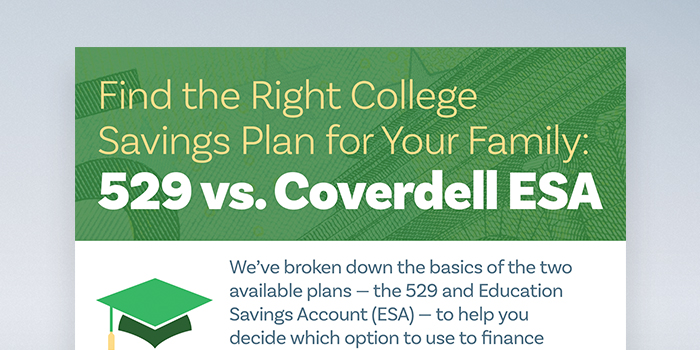

Utma Vs Ugma Vs 529 Plan Best Local Financial Advisors In Salt Lake County Ut Truenorth Wealt

Utma Vs Ugma Vs 529 Plan Best Local Financial Advisors In Salt Lake County Ut Truenorth Wealt

Saving Vs Borrowing Oklahoma 529 College Savings Plan Ocsp

Saving Vs Borrowing Oklahoma 529 College Savings Plan Ocsp

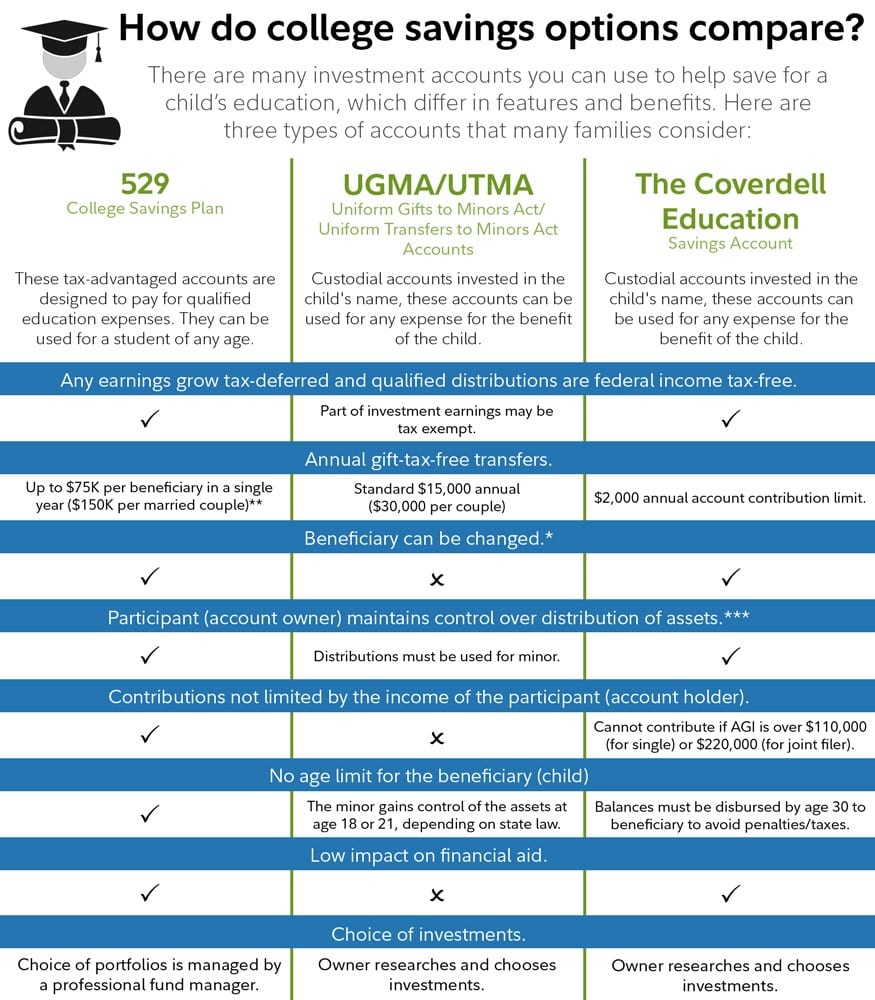

Esa Vs 529 Which Is Better For You Ramseysolutions Com

Esa Vs 529 Which Is Better For You Ramseysolutions Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.