After the temporary consolidation we saw the Bullish Engulfing pattern on the hourly USDCHF chart. This info allows you to see whether market players back up a prices trend or not.

Use Volume Trading Strategy To Win 77 Of Trades

Use Volume Trading Strategy To Win 77 Of Trades

By using this chart we can see where most of the activity took place over the course of a structure.

How to use volume in trading. The high volume already gives us an indication that the buyers are giving the last hard push up. High Volume Nodes or areas with high activity will likely act as points of friction for any future price interactions. This is the reason I am always interested when I see this rotation followed by a trend pattern.

How to Use Volume for Buy and Sell Signals The crossing of the zero level can be used to generate buy and sell signals. If you trade stocks and dont already use this indicator be sure to make use of this article. The easiest approach to do this is to use the information provided in premarket trading.

Volume can also be used to analyze the trend of a stock helping to assess the likelihood that a trend will continue. Indicators for Support or Resistances. So when I see this I use my Flexible Volume Profile.

On the currency market the situation is different but traders can still get insights from volumes. How to use volume in Forex Trading. When they are done with that they manipulate the price into a trend.

For example in the chart below we see that Vereit is. Conversely when the CMF volume indicator crosses below zero its seen as a sell signal. Volume analysis isnt perfect and it offers only supplemental information so you dont need to feel pressured to start analyzing volume to day trade successfully.

In the image above we see a nice Supply zone where the price comes for the first time. They manipulate the price using aggressive Market Orders. This color-coding need not mean there was more down or up volume for the period.

Green bars are printed if the stock closes up for a period and red bars indicate a stock closed lower for a given period. As a trader you should always use the volume indicator when trading the market. He ends the video with some tips.

He also covers why you shouldnt automatically discount low volume. It indicates that there was a match of a buyer and seller 1 contract for one volume. Examples of trading with volume profile.

How to Use the RVOL in trading. The market is moving by executing limit orders which are consumed by market orders. If you trade stocks you have the information about the volumes of trading provided by a stock exchange.

Charlie goes over how to use volume when trading stocks. We have already found out that horizontal volumes help to determine the nearest strong levels. If a bullish trend has pulled back but looks to be breaking support with increasing volume then your exits.

If one contract is traded you will see one. Have a GREAT day-Dale. These are limit orders.

Lets look at a few examples. Put it simply when the CMF volume forex indicator crosses above zero its seen as a buy signal. Videos you watch may be added to the TVs watch history and influence TV.

The trading volume is shown by the Volume Profile. Why use The Volume Profile Structures. More often than not.

For example if you specialise on trading top movers you should use information in premarket trading to find the top movers and their volume. It just represents how the stock closed. As well as entries volume can be used for exits.

If playback doesnt begin shortly try restarting your device. Big trading institutions use the rotation to get into their trading positions. This day trading analysis shows you how to use Volume Profile and Price Action to identify a strong institutional Support on SP 500 index Check it out on the link here.

The trader buys or sells directly into it by a market order. And if we simultaneously look at the volume below we also see that something is happening there. Adding volume as an extra confidence when buying breakouts can help you find the best of the best opportunities as well as find the most liquid stocks.

Most trading platforms Tradingsim included print each volume bar as either green or red. On the stock exchange you will see BID and ASK. This means that with their help we can find a profitable entry point and set benchmarks for Stop Loss or Take Profit.

Areas of low volume are often areas where price will typically speed up if accepted within.

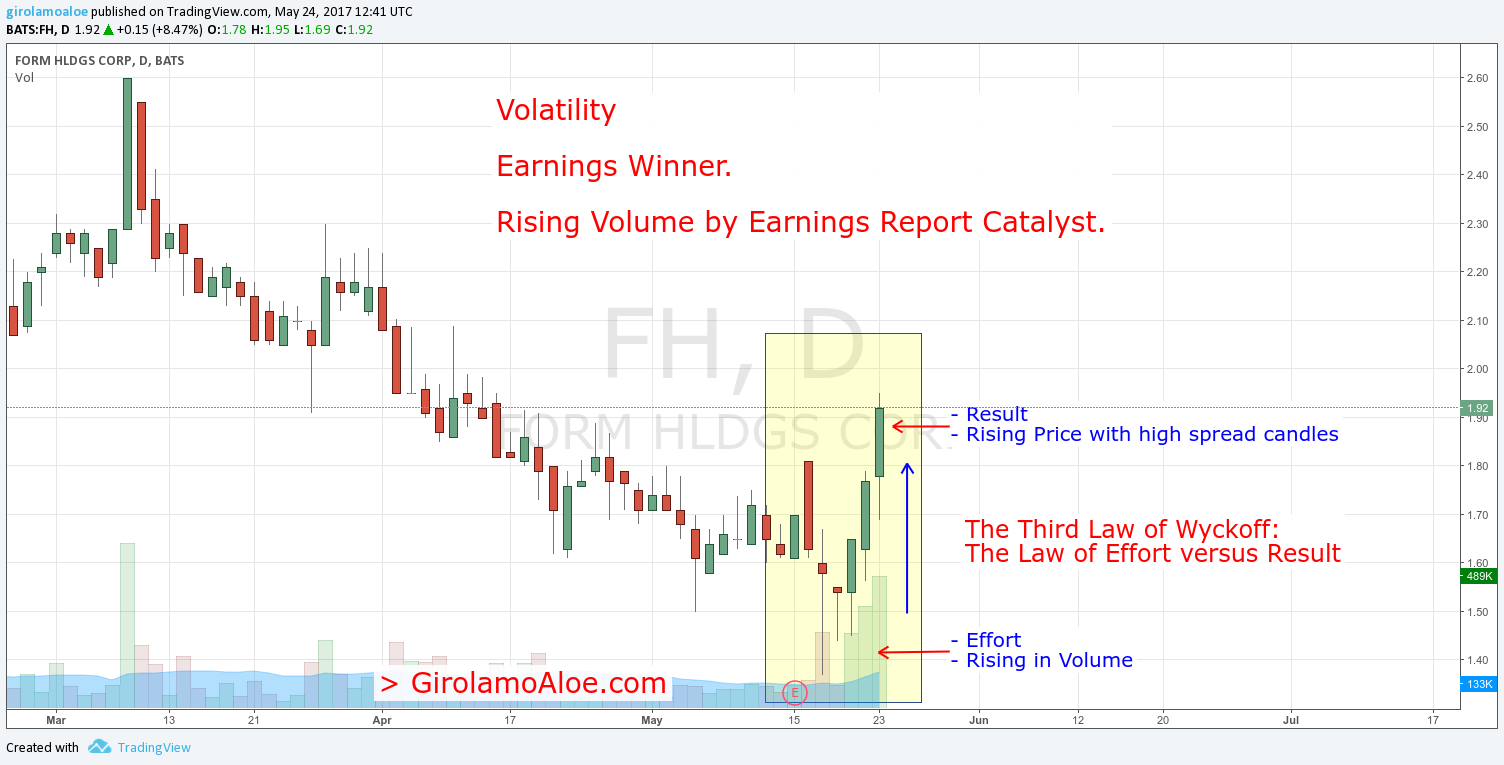

How To Use Volume In Trading Supply Demand Actions Girolamo Aloe

How To Use Volume In Trading Supply Demand Actions Girolamo Aloe

How To Use Volume In Trading Supply Demand Actions Girolamo Aloe

How To Trade With Volume Profile Youtube

How To Trade With Volume Profile Youtube

How To Trade With Volume Profile Futures

4 Simple Volume Trading Strategies

4 Simple Volume Trading Strategies

How To Use Volume In Trading Supply Demand Actions Girolamo Aloe

:max_bytes(150000):strip_icc()/dotdash_Final_Essential_Strategies_for_Trading_Volume_Jun_2020-02-d675ee169b734a44b1b9076cd23cf9d8.jpg) Essential Strategies For Trading Volume

Essential Strategies For Trading Volume

Use Volume Trading Strategy To Win 77 Of Trades

Use Volume Trading Strategy To Win 77 Of Trades

Use Volume Trading Strategy To Win 77 Of Trades

Use Volume Trading Strategy To Win 77 Of Trades

Volume Trading Explained How To Trade On Volume Ig Bank Switzerland

Volume Trading Explained How To Trade On Volume Ig Bank Switzerland

4 Simple Volume Trading Strategies

4 Simple Volume Trading Strategies

/dotdash_Final_Essential_Strategies_for_Trading_Volume_Jun_2020-01-0c77fa0954574ca98c3a60a845d18ffb.jpg) Essential Strategies For Trading Volume

Essential Strategies For Trading Volume

How To Use Volume In Trading Supply Demand Actions Girolamo Aloe

How To Use Volume In Trading Supply Demand Actions Girolamo Aloe

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.